Harley Davidson 2014 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II€

21

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchase of Equity

Securities

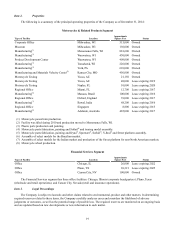

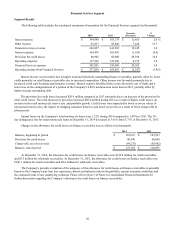

Harley-Davidson, Inc. common stock is traded on the New York Stock Exchange, Inc. The high and low market prices

for the common stock, reported as New York Stock Exchange, Inc. Composite Transactions, were as follows:€

2014 Low High 2013 Low High

First quarter $60.55 $70.04 First quarter $48.40 $55.51

Second quarter $63.74 $74.13 Second quarter $49.15 $59.84

Third quarter $60.24 $70.65 Third quarter $53.35 $65.15

Fourth quarter $54.22 $70.41 Fourth quarter $62.76 $69.75

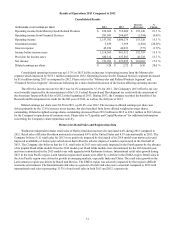

The Company paid the following dividends per share:€

2014 2013 2012

First quarter $0.275 $0.210 $0.155

Second quarter 0.275 0.210 0.155

Third quarter 0.275 0.210 0.155

Fourth quarter 0.275 0.210 0.155

$1.100 $0.840 $0.620

As of January€30, 2015, there were 78,014 shareholders of record of Harley-Davidson, Inc. common stock.

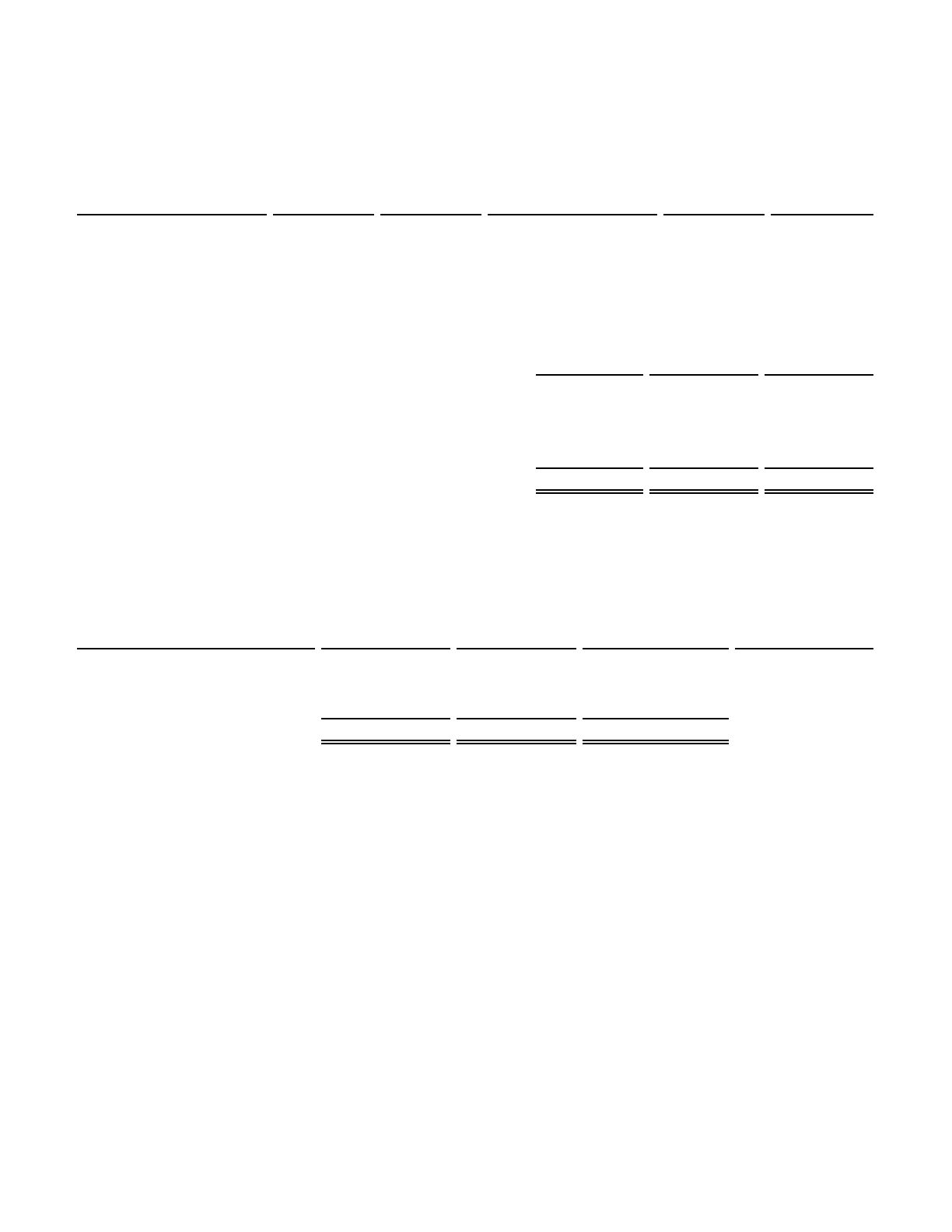

The following table contains detail related to the repurchase of common stock based on the date of trade during the

quarter ended December€31, 2014:

2014 Fiscal Period

Total€Number€of

Shares€Purchased

Average€Price

Paid€per€Share

Total€Number€of€Shares

Purchased€as€Part€of

Publicly€Announced

Plans€or€Programs

Maximum€Number€of

Shares€that€May€Yet€Be

Purchased Under the

Plans or Programs

September 29 to November 2 667,546 $62 667,546 23,364,308

November 3 to November 30 1,585,334 $67 1,585,334 21,999,353

December 1 to December 31 1,084,727 $69 1,084,727 20,942,189

Total 3,337,607 $67 3,337,607

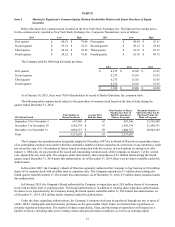

The Company has an authorization (originally adopted in December 1997) by its Board of Directors to repurchase shares

of its outstanding common stock under which the cumulative number of shares repurchased, at the time of any repurchase, shall

not exceed the sum of (1)€the number of shares issued in connection with the exercise of stock options occurring on or after

January€1, 2004 plus (2)€one percent of the issued and outstanding common stock of the Company on January€1 of the current

year, adjusted for any stock split. The company made discretionary share repurchases of 0.3 million shares during the fourth

quarter ended December€31, 2014 under this authorization. As of December€31, 2014, there were no shares available under this

authorization.

In December 2007, the Company’s Board of Directors separately authorized the Company to buy back up to 20.0€million

shares of its common stock with no dollar limit or expiration date. The Company repurchased 3.1 million shares during the

fourth quarter ended December€31, 2014 under this authorization. As of December€31, 2014, 0.9 million shares remained under

this authorization.

In February 2014, the Company's Board authorized the Company to repurchase up to 20.0 million shares of its common

stock with no dollar limit or expiration date. This board authorization is in addition to existing share repurchase authorizations.

No shares were repurchased by the Company during the fourth quarter ended December€31, 2014 under this authorization. As

of December€31, 2014, 20.0 million shares remained under this authorization.

Under the share repurchase authorizations, the Company’s common stock may be purchased through any one or more of

a Rule 10b5-1 trading plan and discretionary purchases on the open market, block trades, accelerated share repurchases or

privately negotiated transactions. The number of shares repurchased, if any, and the timing of repurchases will depend on a

number of factors, including share price, trading volume and general market conditions, as well as on working capital