Harley Davidson 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

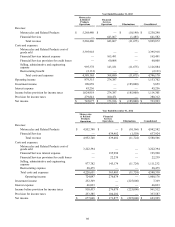

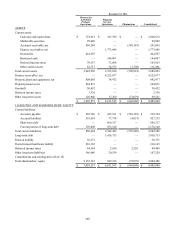

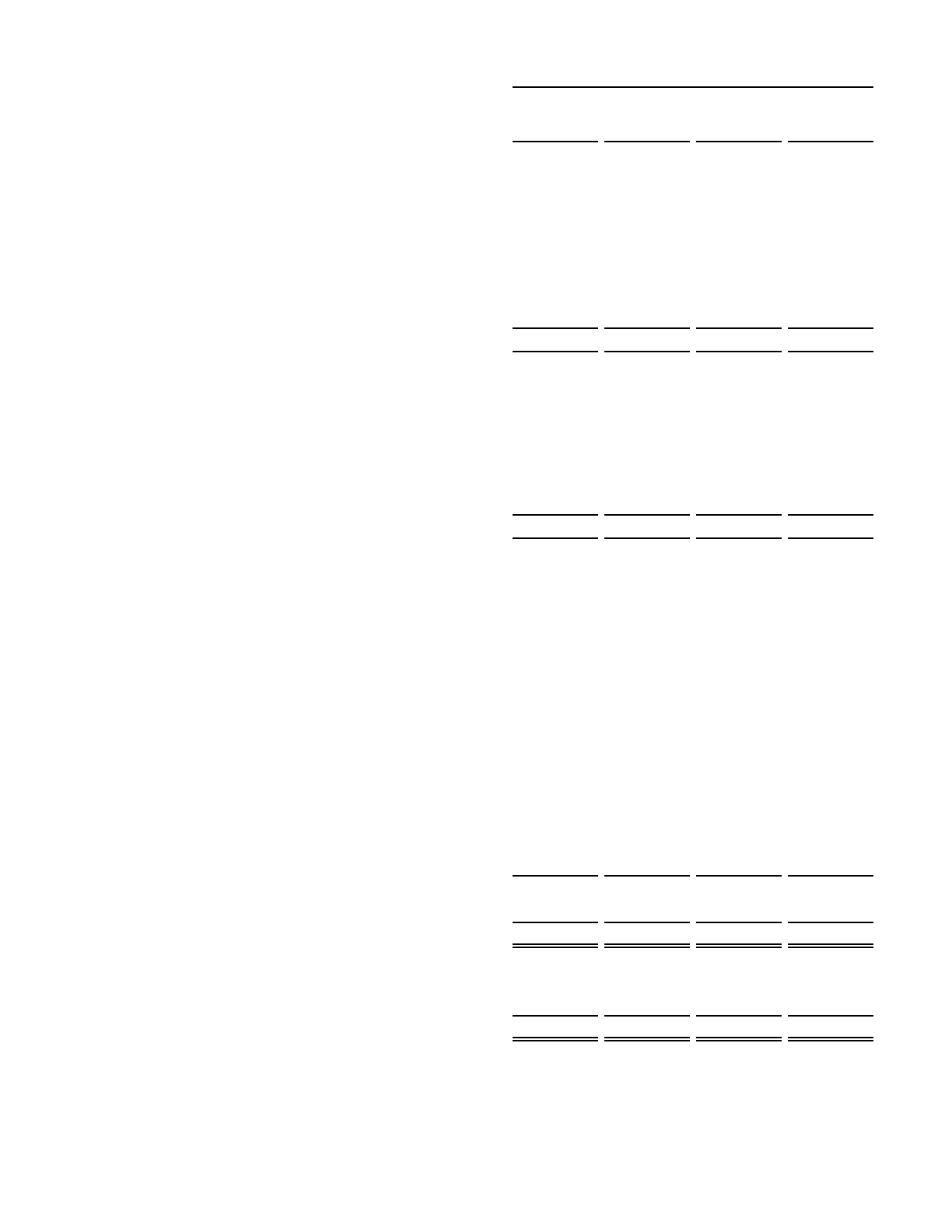

Year Ended December 31, 2012

Motorcycles

& Related

Products

Operations

Financial

Services

Operations

Eliminations

&

Adjustments Consolidated

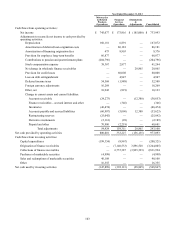

Change in current assets and current liabilities:

Accounts receivable 9,323 — (23,013)(13,690)

Finance receivables – accrued interest and other — (4)— (4)

Inventories 21,459 — — 21,459

Accounts payable and accrued liabilities (6,368)(27,443)23,013 (10,798)

Restructuring reserves (16,087)— — (16,087)

Derivative instruments 2,906 (148)— 2,758

Prepaid and other (95,162)(2,554)— (97,716)

Total adjustments 71,440 103,580 2,513 177,533

Net cash provided by operating activities 748,488 275,457 (222,487)801,458

Cash flows from investing activities:

Capital expenditures (180,416)(8,586)— (189,002)

Origination of finance receivables — (6,544,828)3,686,127 (2,858,701)

Collections of finance receivables — 6,456,729 (3,688,640)2,768,089

Purchases of marketable securities (4,993)— — (4,993)

Sales and redemptions of marketable securities 23,296 — — 23,296

Net cash used by investing activities (162,113)(96,685)(2,513)(261,311)

Cash flows from financing activities:

Proceeds from issuance of medium-term notes — 993,737 — 993,737

Repayment of medium-term notes — (420,870)— (420,870)

Intercompany borrowing activity (400,000)400,000 — —

Proceeds from securitization debt — 763,895 — 763,895

Repayments of securitization debt — (1,405,599)— (1,405,599)

Borrowings of asset-backed commercial paper — 200,417 — 200,417

Net decrease in credit facilities and unsecured commercial

paper

— (744,724)— (744,724)

Repayments of asset-backed commercial paper — (24,301)— (24,301)

Net change in restricted cash — 41,647 — 41,647

Dividends paid (141,681)(225,000)225,000 (141,681)

Purchase of common stock for treasury, net of issuances (311,632)— — (311,632)

Excess tax benefits from share based payments 13,065 — — 13,065

Issuance of common stock under employee stock option plans 45,973 — — 45,973

Net cash used by financing activities (794,275)(420,798)225,000 (990,073)

Effect of exchange rate changes on cash and cash equivalents (7,714)(1,172)— (8,886)

Net decrease in cash and cash equivalents $(215,614) $ (243,198) $ —$(458,812)

Cash and cash equivalents:

Cash and cash equivalents – beginning of period $943,330 $583,620 $—$1,526,950

Net decrease in cash and cash equivalents (215,614)(243,198)— (458,812)

Cash and cash equivalents – end of period $727,716 $340,422 $—$1,068,138

105

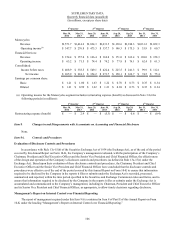

22.€€€€Subsequent Events

On January 22, 2015, HDFS issued $700.0 million of secured notes through a term asset-backed securitization transaction

at a weighted average interest rate of 1.19%.