Harley Davidson 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

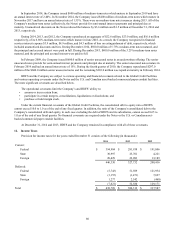

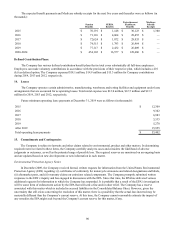

The expected benefit payments and Medicare subsidy receipts for the next five years and thereafter were as follows (in

thousands):€

Pension

Benefits

SERPA

Benefits

Postretirement

Healthcare

Benefits

Medicare

Subsidy

Receipts

2015 $70,191 $1,148 $30,123 $1,380

2016 $71,110 $4,064 $28,455 $—

2017 $72,624 $1,872 $28,035 $—

2018 $74,515 $1,793 $26,964 $—

2019 $77,117 $2,432 $26,009 $—

2020-2024 $454,102 $16,577 $128,686 $—

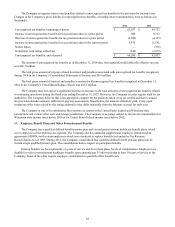

Defined Contribution Plans:

The Company has various defined contribution benefit plans that in total cover substantially all full-time employees.

Employees can make voluntary contributions in accordance with the provisions of their respective plan, which includes a 401

(k) tax deferral option. The Company expensed $18.1 million, $14.9 million and $15.3 million for Company contributions

during 2014, 2013 and 2012, respectively.

90

14.€€€€Leases

The Company operates certain administrative, manufacturing, warehouse and testing facilities and equipment under lease

arrangements that are accounted for as operating leases. Total rental expense was $12.0 million, $12.5 million and $13.5

million for 2014, 2013 and 2012, respectively.

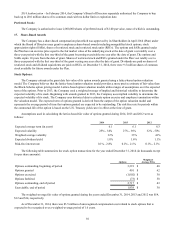

Future minimum operating lease payments at December€31, 2014 were as follows (in thousands):€

2015 $12,309

2016 9,342

2017 6,983

2018 5,535

2019 5,278

After 2019 15,955

Total operating lease payments $55,402

15.€€€€Commitments and Contingencies

The Company is subject to lawsuits and other claims related to environmental, product and other matters. In determining

required reserves related to these items, the Company carefully analyzes cases and considers the likelihood of adverse

judgments or outcomes, as well as the potential range of possible loss. The required reserves are monitored on an ongoing basis

and are updated based on new developments or new information in each matter.

Environmental Protection Agency Notice

In December 2009, the Company received formal, written requests for information from the United States Environmental

Protection Agency (EPA) regarding: (i)€certificates of conformity for motorcycle emissions and related designations and labels,

(ii)€aftermarket parts, and (iii)€warranty claims on emissions related components. The Company promptly submitted written

responses to the EPA’s inquiry and has engaged in discussions with the EPA. Since that time, the EPA has delivered various

additional requests for information to which the Company has responded. It is probable that a result of the EPA’s investigation

will be some form of enforcement action by the EPA that will seek a fine and/or other relief. The Company has a reserve

associated with this matter which is included in accrued liabilities in the Consolidated Balance Sheet. However, given the

uncertainty that still exists concerning the resolution of this matter, there is a possibility that the actual loss incurred may be

materially different than the Company’s current reserve. At this time, the Company cannot reasonably estimate the impact of

any remedies the EPA might seek beyond the Company's current reserve for this matter, if any.