Harley Davidson 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

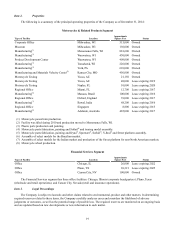

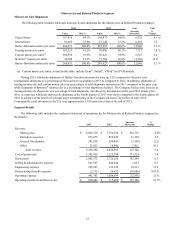

Results of Operations 2014 Compared to 2013

Consolidated Results€

(in thousands, except earnings per share) 2014 2013

Increase

(Decrease)

%

Change

Operating income from Motorcycles€& Related Products $1,003,147 $870,609 $132,538 15.2 %

Operating income from Financial Services 277,836 283,093 (5,257)(1.9)%

Operating income 1,280,983 1,153,702 127,281 11.0 %

Investment income 6,499 5,859 640 10.9 %

Interest expense 4,162 45,256 (41,094)(90.8)%

Income before income taxes 1,283,320 1,114,305 169,015 15.2 %

Provision for income taxes 438,709 380,312 58,397 15.4 %

Net income $844,611 $733,993 $110,618 15.1 %

Diluted earnings per share $3.88 $3.28 $0.60 18.3 %

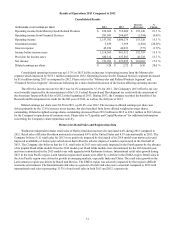

Consolidated operating income was up 11.0% in 2014 led by an increase in operating income from the Motorcycles

segment which improved by $132.5 million compared to 2013. Operating income for the Financial Services segment decreased

by $5.3 million during 2014 as compared to 2013. Please refer to the “Motorcycles and Related Products Segment” and

“Financial Services Segment” discussions following for a more detailed discussion of the factors affecting operating income.

Interest expense was lower in 2014 compared to 2013 due to the retirement of $303 million of senior unsecured long-

term debt in February 2014.

The effective income tax rate for 2014 was 34.2% compared to 34.1% for 2013. The Company's 2014 and 2013 effective

tax rate included U.S. Federal Research and Development tax credits that were reinstated by the American Taxpayer Relief

Act.€The effective tax rate for 2013 also included the full-impact of the 2012 U.S. Federal Research and Development tax credit

due to the timing of the enactment of the American Taxpayer Relief Act.

Diluted earnings per share were $3.88 in 2014, up 18.3% over 2013. The increase in diluted earnings per share was

driven primarily by the 15.1% increase in net income, but also benefited from lower diluted weighted average shares

outstanding. Diluted weighted average shares outstanding decreased from 224.1 million in 2013 to 217.7 million in 2014 driven

by the Company's repurchases of common stock. Please refer to "Liquidity and Capital Resources" for additional information

concerning the Company's share repurchase activity.

26

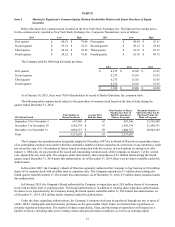

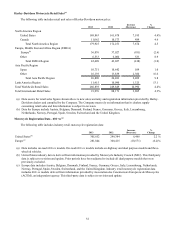

Motorcycle Retail Sales and Registration Data

Worldwide independent dealer retail sales of Harley-Davidson motorcycles increased 2.7% during 2014 compared to

2013. Retail sales of Harley-Davidson motorcycles increased 1.3% in the United States and 5.4% internationally in 2014.

The Company believes U.S. retail sales for 2014 benefited from strong sales of Rushmore and Street motorcycles that

were partially offset by adverse impacts that resulted from the absence of Road Glide motorcycles for most of the year and very

difficult weather conditions in the first half of the year.

International retail sales growth during 2014 in the Asia Pacific region, Latin America region and EMEA region was

partially offset by a decline in Canada. Retail sales in the Asia Pacific region were driven by growth in emerging markets,

especially India and China. The retail sales growth in the Latin America region was driven by Mexico. The EMEA region retail

sales growth was driven by growth in nearly all countries throughout the region. International retail sales as a percent of total

retail sales in 2014 were 36.2% of total retail sales compared to 35.3% in 2013.

The Company is encouraged by the 2014 performance of retail sales in international markets, but remains concerned with

ongoing economic challenges in several markets. Going forward, the Company will continue to focus on factors it can control

which include building its brand experience across the world and expanding its distribution network in emerging markets.