Harley Davidson 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

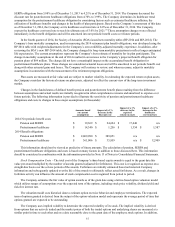

aggregate commitments under the Global Credit Facilities. The Global Credit Facilities are committed facilities and primarily

used to support the Company's unsecured commercial paper program.

Unsecured Commercial Paper – Subject to limitations, the Company could issue unsecured commercial paper of up to

$1.35 billion as of December€31, 2014 supported by the Global Credit Facilities. Outstanding unsecured commercial paper may

not exceed the unused portion of the Global Credit Facilities. Maturities may range up to 365 days from the issuance date. The

Company intends to repay unsecured commercial paper as it matures with additional unsecured commercial paper or through

other means, such as borrowing under the Global Credit Facilities, borrowing under its asset-backed U.S. commercial paper

conduit facility or through the use of operating cash flow and cash on hand.(1)

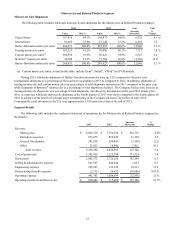

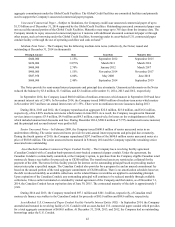

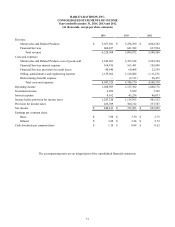

Medium-Term Notes – The Company has the following medium-term notes (collectively, the Notes) issued and

outstanding at December€31, 2014 (in thousands):€

Principal Amount Rate Issue Date Maturity Date

$600,000 1.15% September 2012 September 2015

$450,000 3.875% March 2011 March 2016

$400,000 2.70% January 2012 March 2017

$400,000 1.55% November 2014 November 2017

$887,958 6.80% May 2008 June 2018

$600,000 2.40% September 2014 September 2019

The Notes provide for semi-annual interest payments and principal due at maturity. Unamortized discounts on the Notes

reduced the balance by $3.6 million, $1.5 million, and $2.2 million at December€31, 2014, 2013 and 2012, respectively.

In September 2014, the Company issued $600.0 million of medium-term notes which mature in September 2019 and have

an annual interest rate of 2.40%. In November 2014, the Company issued $400.0 million of medium-term notes which mature

in November 2017 and have an annual interest rate of 1.55%. There were no medium-term note issuances during 2013.

During 2014, 2013 and 2012, the Company repurchased an aggregate $22.6 million, $23.0 million, and $16.6 million,

respectively, of its 6.80% medium-term notes which mature in June 2018. As a result, the Company recognized in financial

services interest expense $3.9 million, $4.9 million and $4.3 million, respectively, for losses on the extinguishment of debt,

which included unamortized discounts and fees. During December 2014, $500.0 million of 5.75% medium-term notes matured,

and the principal and accrued interest were paid in full.

Senior Unsecured Notes – In February 2009, the Company issued $600.0 million of senior unsecured notes in an

underwritten offering. The senior unsecured notes provide for semi-annual interest payments and principal due at maturity.

During the fourth quarter of 2010, the Company repurchased $297.0 million of the $600.0 million senior unsecured notes at a

price of $380.8 million. The senior unsecured notes matured in February 2014 and the Company repaid the remaining senior

unsecured notes outstanding.

Asset-Backed Canadian Commercial Paper Conduit Facility – The Company has a revolving facility agreement

(Canadian Conduit) with a Canadian bank-sponsored asset-backed commercial paper conduit. Under the agreement, the

Canadian Conduit is contractually committed, at the Company's option, to purchase from the Company eligible Canadian retail

motorcycle finance receivables for proceeds up to C$200 million. The transferred assets are restricted as collateral for the

payment of the debt. The terms for this facility provide for interest on the outstanding principal based on prevailing market

interest rates plus a specified margin. The Canadian Conduit also provides for a program fee and an unused commitment fee

based on the unused portion of the total aggregate commitment of C$200 million. There is no amortization schedule; however,

the debt is reduced monthly as available collections on the related finance receivables are applied to outstanding principal.

Upon expiration of the Canadian Conduit, any outstanding principal will continue to be reduced monthly through available

collections. Unless earlier terminated or extended by mutual agreement of the Company and the lenders, as of December 31,

2014, the Canadian Conduit has an expiration date of June 30, 2015. The contractual maturity of the debt is approximately 5

years.

During 2014 and 2013, the Company transferred $97.1 million and $101.1 million, respectively, of Canadian retail

motorcycle finance receivables to the Canadian Conduit for proceeds of $85.0 million and $88.6 million, respectively.

Asset-Backed U.S. Commercial Paper Conduit Facility Variable Interest Entity (VIE) – In September 2014, the Company

amended and restated its revolving facility (U.S. Conduit) with an asset-backed U.S. commercial paper conduit which provides

for a total aggregate commitment of $600.0 million. At December 31, 2014, 2013, and 2012, the Company had no outstanding

borrowings under the U.S. Conduit.

42