Harley Davidson 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

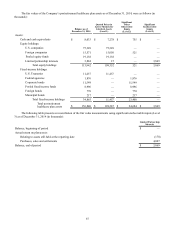

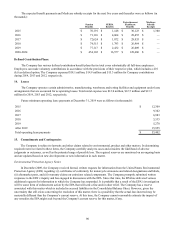

The fair values of the Company’s postretirement healthcare plan assets, which did not contain any Level 3 assets, as of

December€31, 2013, were as follows (in thousands):€

Balance as of

December 31, 2013

Quoted€Prices€in

Active€Markets€for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Assets:

Cash and cash equivalents $8,402 $—$8,402

Equity holdings:

U.S. companies 29,365 29,365 —

Foreign companies 18,010 17,630 380

Pooled equity funds 61,134 61,134 —

Total equity holdings 108,509 108,129 380

Fixed-income holdings:

U.S. Treasuries 9,488 9,488 —

Federal agencies 2,579 — 2,579

Corporate bonds 8,685 — 8,685

Pooled fixed income funds 8,977 — 8,977

Foreign bonds 941 — 941

Municipal bonds 294 — 294

Total fixed-income holdings 30,964 9,488 21,476

Total postretirement healthcare plan assets $147,875 $117,617 $30,258

No plan assets are expected to be returned to the Company during the fiscal year ending December€31, 2015.

For 2015, the Company’s overall expected long-term rate of return is 7.75% for pension assets and 7.70% for

postretirement healthcare plan assets. The expected long-term rate of return is based on the portfolio as a whole and not on the

sum of the returns on individual asset categories. The return is based on historical returns adjusted to reflect the current view of

the long-term investment market.

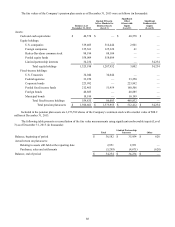

Postretirement Healthcare Cost:

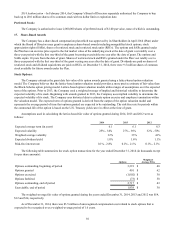

The weighted-average healthcare cost trend rate used in determining the accumulated postretirement benefit obligation of

the healthcare plans was as follows:€

2014 2013

Healthcare cost trend rate for next year 8.0%8.0%

Rate to which the cost trend rate is assumed to decline (the ultimate rate) 5.0%5.0%

Year that the rate reaches the ultimate trend rate 2021 2021

This healthcare cost trend rate assumption can have a significant effect on the amounts reported. A one-percentage-point

change in the assumed healthcare cost trend rate would have the following effects (in thousands):€

One

Percent

Increase

One

Percent

Decrease

Total of service and interest cost components in 2014 $747 $(726)

Accumulated benefit obligation as of December 31, 2014 $12,909 $(12,001)

Future Contributions and Benefit Payments:

No pension plan contributions are required in 2015. The Company expects it will continue to make on-going

contributions related to current benefit payments for SERPA and postretirement healthcare plans in 2015(1).

89