Harley Davidson 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

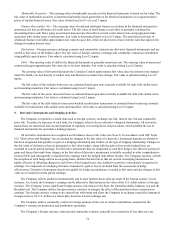

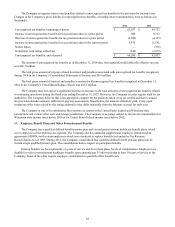

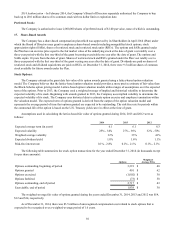

Obligations and Funded Status:

The following table provides the changes in the benefit obligations, fair value of plan assets and funded status of the

Company’s pension, SERPA and postretirement healthcare plans as of the Company’s December€31, 2014 and 2013

measurement dates (in thousands):€

Pension and SERPA Benefits

Postretirement

Healthcare Benefits

2014 2013 2014 2013

Change in benefit obligation:

Benefit obligation, beginning of period $1,714,650 $1,871,575 $366,524 $403,227

Service cost 31,498 35,987 7,015 7,858

Interest cost 86,923 79,248 16,878 15,599

Actuarial (gains) losses 309,542 (199,408)(2,870)(33,729)

Plan participant contributions — — 2,368 2,609

Benefits paid, net of Medicare Part D subsidy (72,633)(72,752)(28,909)(29,040)

Benefit obligation, end of period 2,069,980 1,714,650 361,006 366,524

Change in plan assets:

Fair value of plan assets, beginning of period 1,920,601 1,539,018 147,875 123,106

Actual return on plan assets 143,040 277,388 8,965 24,769

Company contributions 1,638 176,947 28,048 27,849

Plan participant contributions — — 2,368 2,609

Benefits paid (72,633)(72,752)(30,416)(30,458)

Fair value of plan assets, end of period 1,992,646 1,920,601 156,840 147,875

Funded status of the plans, December€31 $(77,334) $ 205,951 $(204,166) $ (218,649)

Amounts recognized in the Consolidated Balance

Sheets, December€31:

Prepaid benefit costs (long-term assets) $—$244,871 $—$—

Accrued benefit liability (current liabilities) (1,148)(2,549)(1,160)(2,484)

Accrued benefit liability (long-term liabilities) (76,186)(36,371)(203,006)(216,165)

Net amount recognized $(77,334) $ 205,951 $(204,166) $ (218,649)

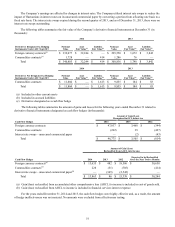

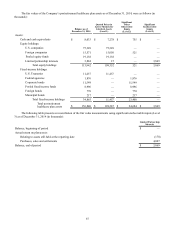

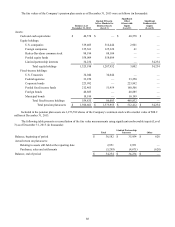

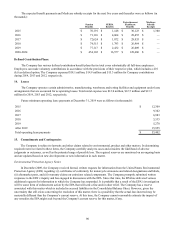

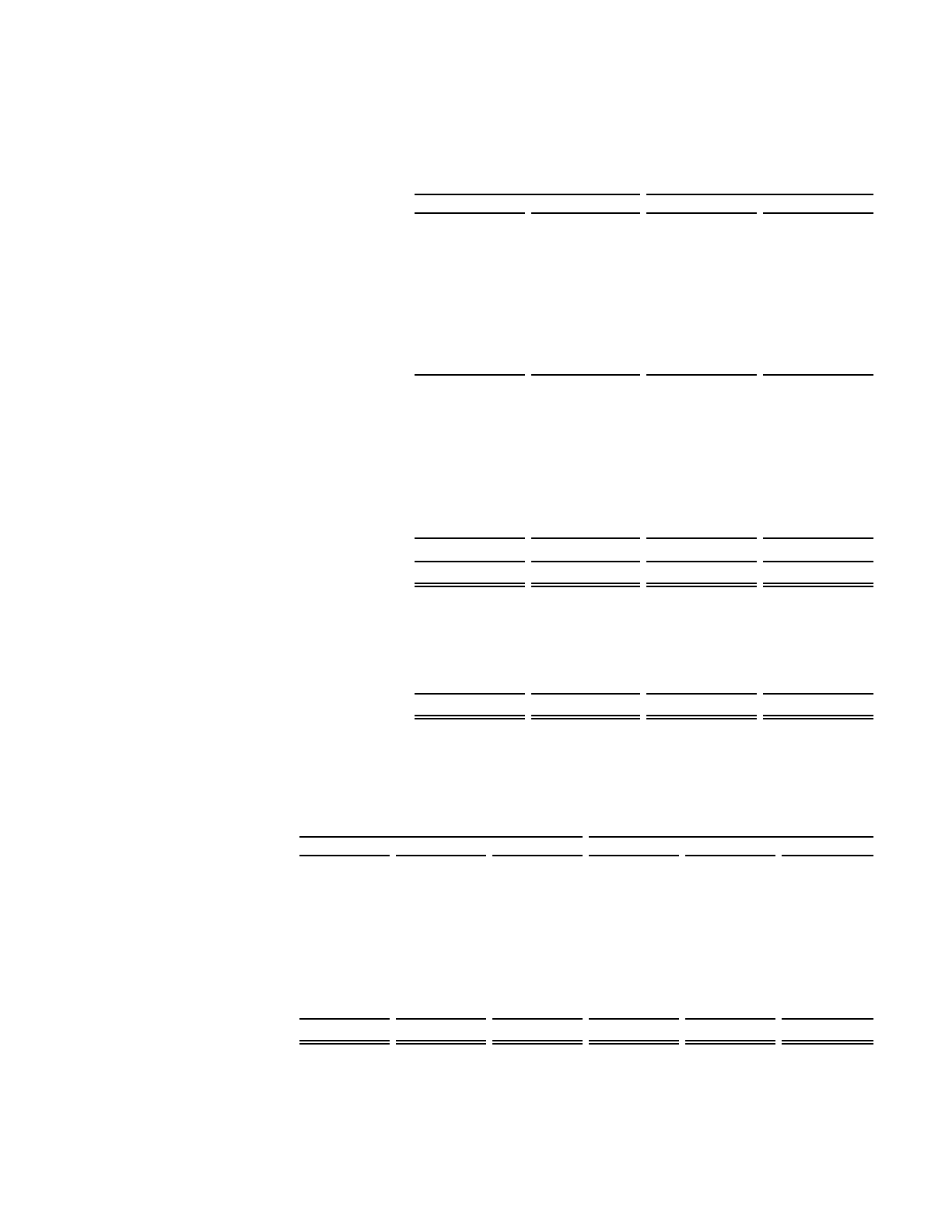

Benefit Costs:

Components of net periodic benefit costs for the years ended December€31 (in thousands):€

Pension and

SERPA Benefits

Postretirement

Healthcare Benefits

2014 2013 2012 2014 2013 2012

Service cost $31,498 $35,987 $33,681 $7,015 $7,858 $7,413

Interest cost 86,923 79,248 83,265 16,878 15,599 18,310

Expected return on plan assets (136,734)(127,327)(117,110)(10,429)(9,537)(9,423)

Amortization of unrecognized:

Prior service cost (credit) 1,119 1,746 2,958 (3,853)(3,853)(3,853)

Net loss 36,563 58,608 43,874 4,729 8,549 7,421

Settlement loss — — 6,242 — — —

Net periodic benefit cost $19,369 $48,262 $52,910 $14,340 $18,616 $19,868

Net periodic benefit costs are allocated among selling, administrative and engineering expense, cost of goods sold and

inventory.

The expected return on plan assets is calculated based on the market-related value of plan assets. The market-related

value of plan assets is different from the fair value in that asset gains/losses are smoothed over a five year period.€

83