Harley Davidson 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

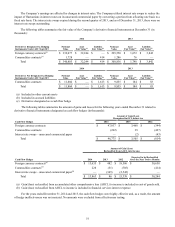

The following table shows the assets and liabilities related to the Company's asset-backed financings that were included

in its financial statements at December 31 (in thousands):

2014

Finance

receivables

Allowance

for credit

losses

Restricted

cash

Other

assets

Total

assets

Asset-backed

debt

On-balance sheet assets and liabilities

Consolidated VIEs

Term asset-backed securitizations $1,458,602 $ (32,156) $ 110,017 $ 2,987 $1,539,450 $ 1,271,533

Asset-backed U.S. commercial paper conduit

facility — — — 422 422 —

Unconsolidated VIEs

Asset-backed Canadian commercial paper

conduit facility 185,099 (2,965)12,035 262 194,431 166,912

Total $1,643,701 $(35,121) $ 122,052 $3,671 $1,734,303 $1,438,445

2013

Finance

receivables

Allowance

for credit

losses

Restricted

cash

Other

assets

Total

assets

Asset-backed

debt

On-balance sheet assets and liabilities

Consolidated VIEs

Term asset-backed securitizations $1,569,118 $(31,778) $ 133,053 $3,720 $1,674,113 $1,256,632

Asset-backed U.S. commercial paper conduit

facility — — — 429 429 —

Unconsolidated VIEs

Asset-backed Canadian commercial paper

conduit facility 204,092 (3,361)11,754 589 213,074 174,241

Total $1,773,210 $(35,139) $ 144,807 $4,738 $1,887,616 $1,430,873

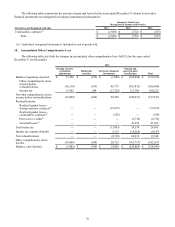

Term Asset-Backed Securitization VIEs

The Company transfers U.S. retail motorcycle finance receivables to SPEs which in turn issue secured notes to investors,

with various maturities and interest rates, secured by future collections of the purchased U.S. retail motorcycle finance

receivables. Each term asset-backed securitization SPE is a separate legal entity and the U.S. retail motorcycle finance

receivables included in the term asset-backed securitizations are only available for payment of the secured debt and other

obligations arising from the term asset-backed securitization transactions and are not available to pay other obligations or

claims of the Company’s creditors until the associated secured debt and other obligations are satisfied. There are no

amortization schedules for the secured notes; however, the debt is reduced monthly as available collections on the related U.S.

retail motorcycle finance receivables are applied to outstanding principal. Restricted cash balances held by the SPEs are used

only to support the securitizations.

In 2014 and 2013, the Company transferred $924.9 million and $680.6 million, respectively, of U.S. retail motorcycle

finance receivables to two separate SPEs. The SPEs in turn issued $850.0 million and $650.0 million, respectively, of secured

notes. At December€31, 2014, the Company's consolidated balance sheet included outstanding balances related to the following

secured notes with the related maturity dates and interest rates (in thousands):€

Issue Date

Principal

Amount at Date of

Issuance

Weighted-Average

Rate at Date of

Issuance Contractual Maturity€Date

April 2014 $850,000 0.66% April 2015 - October 2021

April 2013 $650,000 0.57% May 2014 - December 2020

July 2012 $675,306 0.59% August 2013 - June 2018

November 2011 $513,300 0.88% November 2012 - February 2018

August 2011 $573,380 0.76% September 2012 - August 2017

70