HP 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

HP sells a significant portion of its products through third-party distributors and resellers and, as a

result, maintains individually significant receivable balances with these parties. If the financial condition

or operations of these distributors and resellers deteriorate substantially, HP’s operating results could

be adversely affected. The ten largest distributor and reseller receivable balances collectively, which

were concentrated primarily in North America and Europe, represented approximately 22% of gross

accounts receivable at October 31, 2009 and 18% at October 31, 2008. No single customer accounts for

more than 10% of accounts receivable. Credit risk with respect to other accounts receivable and

financing receivables is generally diversified due to the large number of entities comprising HP’s

customer base and their dispersion across many different industries and geographical regions. HP

performs ongoing credit evaluations of the financial condition of its third-party distributors, resellers

and other customers and requires collateral, such as letters of credit and bank guarantees, in certain

circumstances. To ensure a receivable balance is not overstated due to uncollectibility, an allowance for

doubtful accounts is maintained as required under U.S. GAAP. The past due or delinquency status of a

receivable is based on the contractual payment terms of the receivable. The need to write off a

receivable balance depends on the age, size and a determination of collectability of the receivable. HP

generally has experienced longer accounts receivable collection cycles in its emerging markets, in

particular Asia Pacific and Latin America, compared to its United States and European markets. In the

event that accounts receivable collection cycles in emerging markets significantly deteriorate or one or

more of HP’s larger resellers or enterprise customers fail, HP’s operating results could be adversely

affected.

Other Concentration

HP obtains a significant number of components from single source suppliers due to technology,

availability, price, quality or other considerations. The loss of a single source supplier, the deterioration

of its relationship with a single source supplier, or any unilateral modification to the contractual terms

under which HP is supplied components by a single source supplier could adversely affect HP’s revenue

and gross margins.

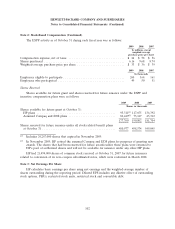

Stock-Based Compensation

Stock-based compensation expense for all share-based payment awards granted is determined

based on the grant-date fair value. HP recognizes these compensation costs net of an estimated

forfeiture rate, and recognizes compensation cost only for those shares expected to vest on a

straight-line basis over the requisite service period of the award, which is generally the vesting term of

the share-based payment awards. HP estimated the forfeiture rate based on its historical experience for

fiscal grant years where the majority of the vesting terms have been satisfied.

Foreign Currency Transactions

HP uses the U.S. dollar predominately as its functional currency. Assets and liabilities

denominated in non-U.S. dollars are remeasured into U.S. dollars at current exchange rates for

monetary assets and liabilities, and historical exchange rates for nonmonetary assets and liabilities. Net

revenue, cost of sales and expenses are remeasured at average exchange rates in effect during each new

reporting period, and net revenue, cost of sales and expenses related to the previously reported periods

are remeasured at historical exchange rates. HP includes gains or losses from foreign currency

remeasurement in net earnings. Certain foreign subsidiaries designate the local currency as their

92