HP 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 7: Goodwill and Purchased Intangible Assets (Continued)

EDS’s foreign subsidiaries whose functional currency is not the U.S. dollar. These increases in goodwill

were partially offset by tax adjustments for various previous acquisitions.

Based on the results of its annual impairment tests, HP determined that no impairment of

goodwill existed as of August 1, 2009 or August 1, 2008. However, future goodwill impairment tests

could result in a charge to earnings. HP will continue to evaluate goodwill on an annual basis as of the

beginning of its fourth fiscal quarter and whenever events and changes in circumstances indicate that

there may be a potential impairment.

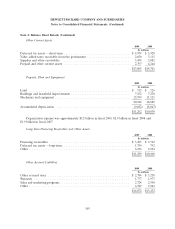

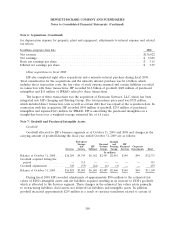

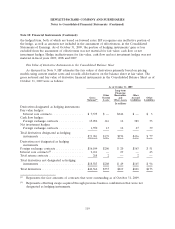

Purchased Intangible Assets

HP’s purchased intangible assets associated with completed acquisitions for each of the following

fiscal years ended October 31 are composed of:

2009 2008

Accumulated Accumulated

Gross Amortization Net Gross Amortization Net

In millions

Customer contracts, customer lists and

distribution agreements .......... $ 6,763 $(3,034) $3,729 $ 6,530 $(2,176) $4,354

Developed and core technology and

patents ...................... 4,171 (2,747) 1,424 4,189 (2,147) 2,042

Product trademarks .............. 247 (222) 25 253 (109) 144

Total amortizable purchased intangible

assets ....................... 11,181 (6,003) 5,178 10,972 (4,432) 6,540

Compaq trade name .............. 1,422 — 1,422 1,422 — 1,422

Total purchased intangible assets ..... $12,603 $(6,003) $6,600 $12,394 $(4,432) $7,962

For fiscal 2009, HP recorded an increase of $83 million to purchased intangibles as a result of

currency translation related to certain of EDS’s foreign subsidiaries whose functional currency is not

the U.S. dollar. HP also recorded an increase of $21 million to the estimated fair value of EDS’s

intangible assets acquired.

Based on the results of its annual impairment tests, HP determined that no impairment of the

Compaq trade name existed as of August 1, 2009 or August 1, 2008. However, future impairment tests

could result in a charge to earnings. HP will continue to evaluate the Compaq trade name on an

annual basis as of the beginning of its fourth fiscal quarter and whenever events and changes in

circumstances indicate that there may be a potential impairment.

The finite-lived purchased intangible assets consist of customer contracts, customer lists and

distribution agreements, which have weighted-average useful lives of 8 years, and developed and core

technology, patents and product trademarks, which have weighted-average useful lives of 5 years.

109