HP 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 8: Restructuring Charges (Continued)

All restructuring costs associated with pre-acquisition EDS are reflected in the purchase price of

EDS. These costs are subject to change based on the actual costs incurred. Changes to these estimates

could decrease the amount of the purchase price allocated to goodwill.

Prior Fiscal Year Plans

Restructuring plans initiated prior to 2008 are substantially complete and HP expects to record

only minor revisions to these plans as necessary.

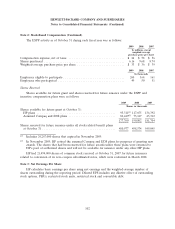

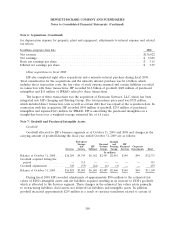

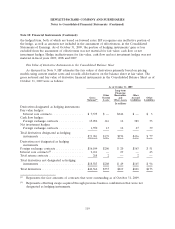

Summary of Restructuring Plans

The adjustments to the accrued restructuring expenses related to all of HP’s restructuring plans

described above for the twelve months ended October 31, 2009 were as follows:

As of October 31, 2009

Fiscal Non-cash Total costs Total

Balance, year 2009 settlements Balance, and expected

October 31, charges Goodwill Cash and other October 31, adjustments costs and

2008 (reversals) adjustments payments adjustments 2009 to date adjustments

Fiscal 2009 Plan .................. $ — $297 $— $ (59) $10 $ 248 $ 297 $ 303

Fiscal 2008 HP/EDS Plan:

Severance .................... $1,444 $279 $ 96 $(1,106) $ 34 $ 747 $1,910 $1,940

Infrastructure .................. 248 67 180 (47) (29) 419 500 935

Total severance and other restructuring

activities .................... $1,692 $346 $276 $(1,153) $ 5 $1,166 $2,410 $2,875

Prior fiscal year plans ............... 77 (3) (2) (25) 4 51 6,343 6,343

Total restructuring plans ............. $1,769 $640 $274 $(1,237) $ 19 $1,465 $9,050 $9,521

At October 31, 2009 and October 31, 2008, HP included the long-term portion of the restructuring

liability of $356 million and $670 million, respectively, in Other liabilities, and the short-term portion in

Accrued restructuring in the accompanying Consolidated Balance Sheets.

Workforce Rebalancing

As part of HP’s ongoing business operations, HP incurred workforce rebalancing charges for

severance and related costs within certain business segments during fiscal 2009. Workforce rebalancing

activities are considered part of normal operations as HP continues to optimize its cost structure.

Workforce rebalancing costs are included in HP’s business segment results, and HP expects to incur

additional workforce rebalancing costs in the future.

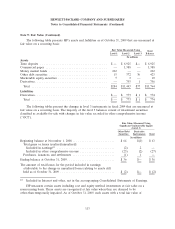

Note 9: Fair Value

HP adopted certain provisions of the new accounting standard related to fair value in the first and

fourth quarters of fiscal 2009. The adoption did not have a material impact on HP’s financial

statements and did not result in any changes to the opening balance of retained earnings as of

November 1, 2008. HP will adopt the remaining provisions related to the fair value of nonfinancial

assets and nonfinancial liabilities in the first quarter of fiscal 2010 for the following major categories of

nonfinancial assets and liabilities from the Consolidated Balance Sheet: Property, plant and equipment,

Goodwill, Purchased intangible assets, and the asset retirement obligations within Other accrued

liabilities and Other liabilities.

111