HP 2009 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

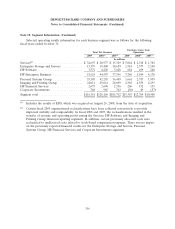

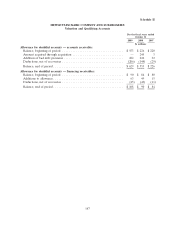

Three-month periods ended

January 31 April 30 July 31 October 31

2008

Net revenue ................................... $28,467 $28,262 $28,032 $33,603

Cost of sales(1) ................................. 21,444(4) 21,205(4) 21,197(4) 25,853(4)

Research and development ........................ 898 908 895 842

Selling, general and administrative ................... 3,296(4) 3,331(4) 3,193(4) 3,506(4)

Amortization of purchased intangible assets ............ 206 211 213 337

In-process research and development charges ........... — 13 — 32

Restructuring charges ............................ 10 4 5 251

Acquisition-related charges ........................ — — — 41

Total costs and expenses .......................... 25,854 25,672 25,503 30,862

Earnings from operations ......................... 2,613 2,590 2,529 2,741

Interest and other, net ............................ 72 3 23 (98)

Earnings before taxes ............................ 2,685 2,593 2,552 2,643

Provision for taxes ............................... 552 536 525 531

Net earnings ................................... $ 2,133 $ 2,057 $ 2,027 $ 2,112

Net earnings per share:(2)

Basic ....................................... $ 0.83 $ 0.83 $ 0.82 $ 0.87

Diluted ..................................... $ 0.80 $ 0.80 $ 0.80 $ 0.84

Cash dividends paid per share ...................... $ 0.08 $ 0.08 $ 0.08 $ 0.08

Range of per share stock prices on the New York Stock

Exchange

Low ....................................... $ 39.99 $ 40.16 $ 40.83 $ 30.03

High ....................................... $ 53.48 $ 49.69 $ 49.97 $ 49.20

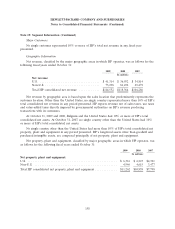

(1) Cost of products, cost of services and financing interest.

(2) EPS for each quarter is computed using the weighted-average number of shares outstanding during

that quarter, while EPS for the fiscal year is computed using the weighted-average number of

shares outstanding during the year. Thus, the sum of the EPS for each of the four quarters may

not equal the EPS for the fiscal year.

(3) As a result of the adoption of ASU 2009-13 and ASU 2009-14, fourth quarter net revenue and net

earnings were higher by $82 million and $19 million, respectively.

(4) Certain pursuit-related costs previously reported as Cost of sales have been realigned retroactively

to Selling, general and administrative expenses due to organizational realignments.

162