HP 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

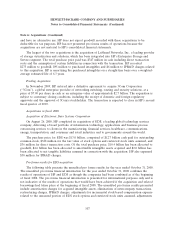

Note 6: Acquisitions (Continued)

and have no alternative use. HP does not expect goodwill recorded with these acquisitions to be

deductible for tax purposes. HP has not presented pro forma results of operations because the

acquisitions are not material to HP’s consolidated financial statements.

The largest of the two acquisitions is the acquisition of Lefthand Networks, Inc., a leading provider

of storage virtualization and solutions, which has been integrated into HP’s Enterprise Storage and

Servers segment. The total purchase price paid was $347 million in cash including direct transaction

costs and the assumption of certain liabilities in connection with the transaction. HP recorded

$273 million to goodwill, $95 million to purchased intangibles and $6 million to IPR&D charges related

to this acquisition. HP is amortizing the purchased intangibles on a straight-line basis over a weighted-

average estimated life of 6.3 years.

Pending Acquisition

In November 2009, HP entered into a definitive agreement to acquire 3Com Corporation

(‘‘3Com’’), a global enterprise provider of networking switching, routing and security solutions, at a

price of $7.90 per share in cash or an enterprise value of approximately $2.7 billion. The acquisition is

subject to customary closing conditions, including the receipt of domestic and foreign regulatory

approvals and the approval of 3Com’s stockholders. The transaction is expected to close in HP’s second

fiscal quarter of 2010.

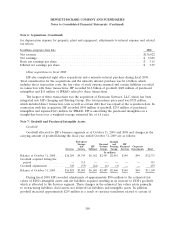

Acquisitions in fiscal 2008

Acquisition of Electronic Data Systems Corporation

On August 26, 2008, HP completed its acquisition of EDS, a leading global technology services

company, delivering a broad portfolio of information technology, applications and business process

outsourcing services to clients in the manufacturing, financial services, healthcare, communications,

energy, transportation, and consumer and retail industries and to governments around the world.

The purchase price for EDS was $13.0 billion, comprised of $12.7 billion cash paid for outstanding

common stock, $328 million for the fair value of stock options and restricted stock units assumed, and

$36 million for direct transaction costs. Of the total purchase price, $10.4 billion has been allocated to

goodwill, $4.6 billion has been allocated to amortizable intangible assets acquired and $2.0 billion has

been allocated to net tangible liabilities assumed in connection with the acquisition. HP also expensed

$30 million for IPR&D charges.

Pro forma results for EDS acquisition

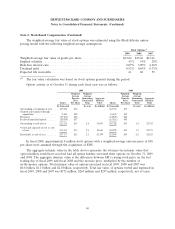

The following table presents the unaudited pro forma results for the year ended October 31, 2008.

The unaudited pro forma financial information for the year ended October 31, 2008 combines the

results of operations of HP and EDS as though the companies had been combined as of the beginning

of fiscal 2008. The pro forma financial information is presented for informational purposes only and is

not indicative of the results of operations that would have been achieved if the acquisition and related

borrowings had taken place at the beginning of fiscal 2008. The unaudited pro forma results presented

include amortization charges for acquired intangible assets, eliminations of intercompany transactions,

restructuring charges, IPR&D charges, adjustments for incremental stock-based compensation expense

related to the unearned portion of EDS stock options and restricted stock units assumed, adjustments

107