HP 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

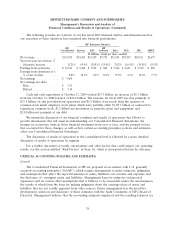

Valuation of Goodwill and Purchased Intangible Assets

We review goodwill and purchased intangible assets with indefinite lives for impairment annually

and whenever events or changes in circumstances indicate the carrying value of an asset may not be

recoverable. The provisions of Accounting Standards Codification Topic 350, ‘‘Intangibles—Goodwill

and Other’’ require that we perform a two-step impairment test on goodwill. In the first step, we

compare the fair value of each reporting unit to its carrying value. Our reporting units are consistent

with the reportable segments identified in Note 19 to the Consolidated Financial Statements in Item 8.

We determine the fair value of our reporting units based on a weighting of income and market

approaches. Under the income approach, we calculate the fair value of a reporting unit based on the

present value of estimated future cash flows. Under the market approach, we estimate the fair value

based on market multiples of revenue or earnings for comparable companies. If the fair value of the

reporting unit exceeds the carrying value of the net assets assigned to that unit, goodwill is not

impaired and we are not required to perform further testing. If the carrying value of the net assets

assigned to the reporting unit exceeds the fair value of the reporting unit, then we must perform the

second step of the impairment test in order to determine the implied fair value of the reporting unit’s

goodwill. If the carrying value of a reporting unit’s goodwill exceeds its implied fair value, then we

record an impairment loss equal to the difference. We also compare the fair value of purchased

intangible assets with indefinite lives to their carrying value. We estimate the fair value of these

intangible assets using an income approach. We recognize an impairment loss when the estimated fair

value of the intangible asset is less than the carrying value.

Determining the fair value of a reporting unit or an indefinite-lived purchased intangible asset is

judgmental in nature and involves the use of significant estimates and assumptions. These estimates

and assumptions include revenue growth rates and operating margins used to calculate projected future

cash flows, risk-adjusted discount rates, assumed royalty rates, future economic and market conditions

and determination of appropriate market comparables. We base our fair value estimates on

assumptions we believe to be reasonable but that are unpredictable and inherently uncertain. Actual

future results may differ from those estimates. In addition, we make certain judgments and assumptions

in allocating shared assets and liabilities to determine the carrying values for each of our reporting

units.

Our annual goodwill impairment analysis, which we performed during the fourth quarter of fiscal

2009, did not result in an impairment charge. The excess of fair value over carrying value for each of

HP’s reporting units as of August 1, 2009, the annual testing date, ranged from approximately

$750 million to approximately $35 billion. In order to evaluate the sensitivity of the fair value

calculations on the goodwill impairment test, we applied a hypothetical 10% decrease to the fair values

of each reporting unit. This hypothetical 10% decrease would result in excess fair value over carrying

value ranging from approximately $550 million to approximately $31 billion for each of HP’s reporting

units.

Fair Value of Financial Instruments

We measure certain financial assets and liabilities at fair value based on valuation techniques using

the best information available, which may include quoted market prices, market comparables, and

discounted cash flow projections. Financial instruments are primarily comprised of time deposits,

money market funds, commercial paper, corporate and other debt securities, equity securities and other

investments in common stock and common stock equivalents and derivative instruments.

44