HP 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

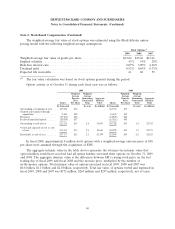

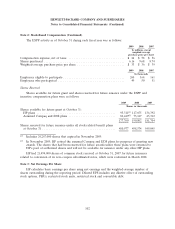

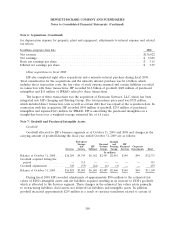

Note 3: Net Earnings Per Share (Continued)

The reconciliation of the numerators and denominators of the basic and diluted EPS calculations

was as follows for the following fiscal years ended October 31:

2009 2008 2007

In millions, except per share

amounts

Numerator:

Net earnings ............................................. $7,660 $8,329 $7,264

Adjustment for interest expense on zero-coupon subordinated convertible

notes, net of taxes ....................................... — 3 7

Net earnings, adjusted ...................................... $7,660 $8,332 $7,271

Denominator:

Weighted-average shares used to compute basic EPS ................ 2,388 2,483 2,630

Effect of dilutive securities:

Dilution from employee stock plans ........................... 49 81 78

Zero-coupon subordinated convertible notes .................... — 3 8

Dilutive potential common shares .............................. 49 84 86

Weighted-average shares used to compute diluted EPS ............... 2,437 2,567 2,716

Net earnings per share:

Basic ................................................... $ 3.21 $ 3.35 $ 2.76

Diluted ................................................. $ 3.14 $ 3.25 $ 2.68

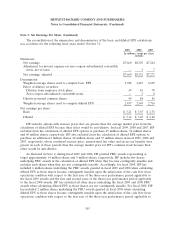

HP excludes options with exercise prices that are greater than the average market price from the

calculation of diluted EPS because their effect would be anti-dilutive. In fiscal 2009, 2008 and 2007, HP

excluded from the calculation of diluted EPS options to purchase 85 million shares, 54 million shares

and 60 million shares, respectively. HP also excluded from the calculation of diluted EPS options to

purchase an additional 2 million shares, 28 million shares and 33 million shares in fiscal 2009, 2008 and

2007, respectively, whose combined exercise price, unamortized fair value and excess tax benefits were

greater in each of those periods than the average market price for HP’s common stock because their

effect would be anti-dilutive.

As disclosed in Note 2, during fiscal 2009 and 2008, HP granted PRU awards representing at

target approximately 14 million shares and 9 million shares, respectively. HP includes the shares

underlying PRU awards in the calculation of diluted EPS when they become contingently issuable and

excludes such shares when they are not contingently issuable. Accordingly, for fiscal 2009, HP has

included 6 million shares underlying the PRU awards granted in fiscal 2009 and 2008 when calculating

diluted EPS as those shares became contingently issuable upon the satisfaction of the cash flow from

operations condition with respect to the first year of the three-year performance period applicable to

the fiscal 2009 awards and the first and second years of the three-year performance period applicable

to the fiscal 2008 awards. HP has excluded all other shares underlying the fiscal 2009 and 2008 PRU

awards when calculating diluted EPS as those shares are not contingently issuable. For fiscal 2008, HP

has included 2 million shares underlying the PRU awards granted in fiscal 2008 when calculating

diluted EPS as those shares became contingently issuable upon the satisfaction of the cash flow from

operations condition with respect to the first year of the three-year performance period applicable to

103