HP 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

During the fourth quarter of fiscal 2009, we adopted the FASB Accounting Standards Codification

and the Hierarchy of Generally Accepted Accounting Principles which only affected the specific

references to GAAP literature in the notes to our consolidated financial statements.

In October 2009, the FASB issued ASU 2009-13. The new standard changes the requirements for

establishing separate units of accounting in a multiple element arrangement and requires the allocation

of arrangement consideration to each deliverable to be based on the relative selling price. Concurrently

to issuing ASU 2009-13, the FASB also issued ASU 2009-14. ASU 2009-14 excludes software that is

contained on a tangible product from the scope of software revenue guidance if the software is

essential to the tangible product’s functionality.

A further discussion of the financial impact of ASU 2009-13 and ASU 2009-14 appears under

‘‘Critical Accounting Policies and Estimates’’ above.

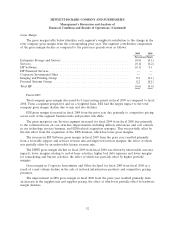

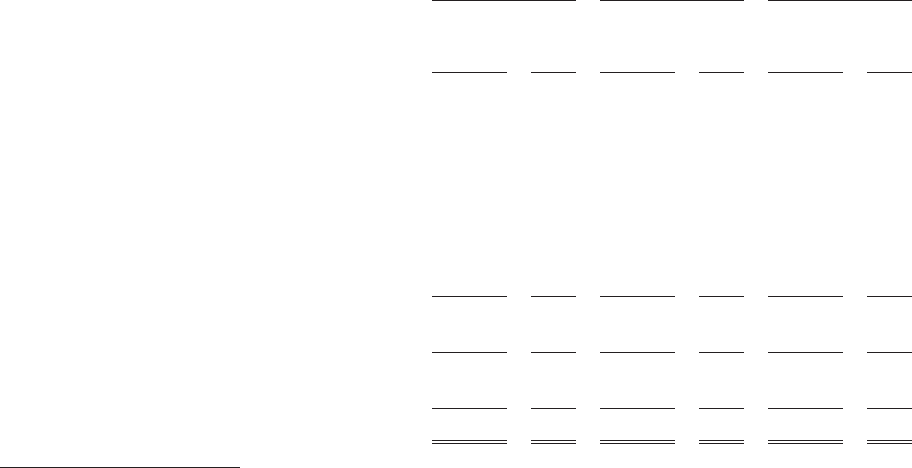

RESULTS OF OPERATIONS

The following discussion compares the historical results of operations on a GAAP basis for the

fiscal years ended October 31, 2009, 2008, and 2007. We have included the results of the business

operations acquired from EDS in our consolidated results of operations beginning on August 26, 2008,

the closing date of the EDS acquisition.

Results of operations in dollars and as a percentage of net revenue were as follows for the

following fiscal years ended October 31:

2009 2008 2007

In millions

Net revenue ......................... $114,552 100.0% $118,364 100.0% $104,286 100.0%

Cost of sales(1) ....................... 87,524 76.4% 89,699(2) 75.8% 78,683(2) 75.4%

Gross profit ......................... 27,028 23.6% 28,665 24.2% 25,603 24.6%

Research and development .............. 2,819 2.5% 3,543 3.0% 3,611 3.5%

Selling, general and administrative ......... 11,613 10.1% 13,326(2) 11.3% 12,430(2) 11.9%

Amortization of purchased intangible assets . . 1,571 1.4% 967 0.9% 783 0.7%

In-process research and development charges . 7 — 45 — 190 0.2%

Restructuring charges .................. 640 0.6% 270 0.2% 387 0.4%

Acquisition-related charges .............. 242 0.2% 41 — — —

Pension curtailments and pension settlements,

net.............................. — — — — (517) (0.5)%

Earnings from operations ............... 10,136 8.8% 10,473 8.8% 8,719 8.4%

Interest and other, net ................. (721) (0.6)% — — 458 0.4%

Earnings before taxes .................. 9,415 8.2% 10,473 8.8% 9,177 8.8%

Provision for taxes .................... 1,755 1.5% 2,144 1.8% 1,913 1.8%

Net earnings ......................... $ 7,660 6.7% $ 8,329 7.0% $ 7,264 7.0%

(1) Cost of products, cost of services and financing interest.

(2) Certain pursuit-related costs previously reported under Cost of sales have been realigned

retroactively to Selling, general and administrative expenses due to organizational realignments.

49