HP 2009 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

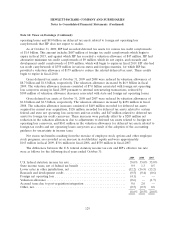

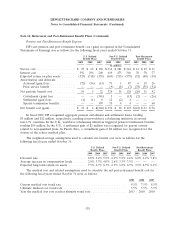

Note 16: Retirement and Post-Retirement Benefit Plans (Continued)

A 1.0 percentage point increase in the medical cost trend rate would have increased the fiscal 2009

service and interest components of the post-retirement benefit costs by $0.2 million, while a

1.0 percentage point decrease would have resulted in a decrease of $0.1 million in the same period.

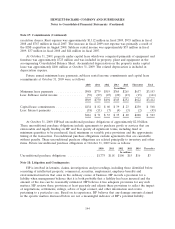

Funded Status

The funded status of the defined benefit and post-retirement benefit plans was as follows for the

following fiscal years ended October 31:

U.S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

2009 2008 2009 2008 2009 2008

In millions

Change in fair value of plan assets:

Fair value — beginning of year ......... $ 7,313 $ 4,258 $ 9,507 $ 9,816 $ 401 $ 489

Addition of plan — EDS ............. — 4,090 — 3,749 — —

Acquisition/addition/(deletion) of plans . . . — — (4) 19 — —

Actual return on plan assets ........... 1,509 (782) 856 (2,673) (15) (56)

Employer contributions .............. 55 25 531 145 31 52

Participants’ contributions ............. — — 84 84 9 48

Benefits paid ...................... (488) (274) (449) (302) (74) (131)

Settlements ....................... (18) (4) (125) (15) — —

Currency impact ................... — — 925 (1,316) — —

Fair value — end of year ............. 8,371 7,313 11,325 9,507 352 402

Change in benefit obligation:

Projected benefit obligation — beginning

of year ......................... $ 7,654 $ 3,982 $10,468 $ 8,426 $1,096 $1,323

Addition of plan — EDS ............. — 4,977 — 5,105 — —

Acquisition/addition/(deletion) of plans . . . — — (40) 34 (9) —

Impact of change in measurement date . . . 21 — 49 — 1 —

Service cost ....................... 27 63 312 281 14 29

Interest cost ....................... 592 296 619 475 70 78

Participants’ contributions ............. — — 84 84 9 48

Actuarial (gain) loss ................. 2,245 (1,386) 2,106 (2,197) 60 (243)

Benefits paid ...................... (488) (274) (449) (302) (74) (131)

Plan amendments ................... 1 — (11) — (179) —

Curtailment ....................... — — (22) — — —

Settlement ........................ (18) (4) (125) (15) — —

Special termination benefits ........... — — 55 4 — —

Currency impact ................... — — 1,098 (1,427) 4 (8)

Projected benefit obligation — end of year . . 10,034 7,654 14,144 10,468 992 1,096

Plan assets less than benefit obligation ..... (1,663) (341) (2,819) (961) (640) (694)

Contributions after measurement date ..... — 6 — 38 — 4

Net amount recognized ................ $(1,663) $ (335) $ (2,819) $ (923) $ (640) $ (690)

Accumulated benefit obligation .......... $10,031 $ 7,652 $13,217 $ 9,726

139