HP 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

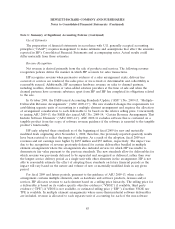

Note 1: Summary of Significant Accounting Policies (Continued)

Use of Estimates

The preparation of financial statements in accordance with U.S. generally accepted accounting

principles (‘‘GAAP’’) requires management to make estimates and assumptions that affect the amounts

reported in HP’s Consolidated Financial Statements and accompanying notes. Actual results could

differ materially from those estimates.

Revenue Recognition

Net revenue is derived primarily from the sale of products and services. The following revenue

recognition policies define the manner in which HP accounts for sales transactions.

HP recognizes revenue when persuasive evidence of a sales arrangement exists, delivery has

occurred or services are rendered, the sales price or fee is fixed or determinable and collectibility is

reasonably assured. Additionally, HP recognizes hardware revenue on sales to channel partners,

including resellers, distributors or value-added solution providers at the time of sale and when the

channel partners have economic substance apart from HP and HP has completed its obligations related

to the sale.

In October 2009, the FASB issued Accounting Standards Update (‘‘ASU’’) No. 2009-13, ‘‘Multiple-

Deliverable Revenue Arrangements’’ (‘‘ASU 2009-13’’). The new standard changes the requirements for

establishing separate units of accounting in a multiple element arrangement and requires the allocation

of arrangement consideration to each deliverable to be based on the relative selling price. Concurrently

to issuing ASU 2009-13, the FASB also issued ASU No. 2009-14, ‘‘Certain Revenue Arrangements That

Include Software Elements’’ (‘‘ASU 2009-14’’). ASU 2009-14 excludes software that is contained on a

tangible product from the scope of software revenue guidance if the software is essential to the tangible

product’s functionality.

HP early adopted these standards as of the beginning of fiscal 2009 for new and materially

modified deals originating after November 1, 2008; therefore, the previously reported quarterly results

have been restated to reflect the impact of adoption. As a result of the adoption, fiscal 2009 net

revenues and net earnings were higher by $255 million and $55 million, respectively. The impact was

due to the recognition of revenue previously deferred for certain deliverables bundled in multiple

element arrangements where the arrangements also included services for which HP was unable to

demonstrate fair value pursuant to the previous standards. The new standards allow for deliverables for

which revenue was previously deferred to be separated and recognized as delivered, rather than over

the longest service delivery period as a single unit with other elements in the arrangement. HP is not

able to reasonably estimate the effect of adopting these standards on future financial periods as the

impact will vary based on the nature and volume of new or materially modified deals in any given

period.

For fiscal 2009 and future periods, pursuant to the guidance of ASU 2009-13, when a sales

arrangement contains multiple elements, such as hardware and software products, licenses and/or

services, HP allocates revenue to each element based on a selling price hierarchy. The selling price for

a deliverable is based on its vendor specific objective evidence (‘‘VSOE’’) if available, third party

evidence (‘‘TPE’’) if VSOE is not available, or estimated selling price (‘‘ESP’’) if neither VSOE nor

TPE is available. In multiple element arrangements where more-than-incidental software deliverables

are included, revenue is allocated to each separate unit of accounting for each of the non-software

85