HP 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

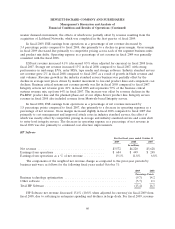

Selling, General and Administrative

Selling, general and administrative (‘‘SG&A’’) expense decreased in fiscal 2009 from fiscal 2008

due primarily to favorable currency impacts related to the movement of the dollar against the euro,

lower compensation expense as well as effective cost management, the impact of which was partially

offset by additional expenses related to the EDS acquisition. In fiscal 2009, SG&A expense as a

percentage of net revenue decreased for each of our segments, except for Corporate Investments.

Total SG&A expense increased in fiscal 2008 due primarily to higher field selling costs as a result

of our investments in sales resources, unfavorable currency impacts related to the movement of the

dollar against the euro, and additional expenses related to the EDS acquisition. Each of our major

segments experienced a year-over-year decrease in SG&A expense as a percentage of net revenue

during fiscal 2008.

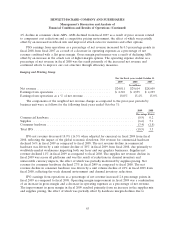

Amortization of Purchased Intangible Assets

The increase in amortization expense in fiscal 2009 from fiscal 2008 was due primarily to

amortization expenses related to the intangible assets purchased as part of the EDS acquisition.

The increase in amortization expense during fiscal 2008 as compared to fiscal 2007 was due

primarily to amortization expenses related to the intangible assets purchased as part of the EDS

acquisition as well as other acquisitions made in fiscal 2008.

For more information on our amortization of purchased intangibles assets, see Note 7 to the

Consolidated Financial Statements in Item 8, which is incorporated herein by reference.

In-Process Research and Development Charges

We record IPR&D charges in connection with acquisitions accounted for as business combinations

as more fully described in Note 6 to the Consolidated Financial Statements in Item 8. In fiscal 2009,

fiscal 2008 and fiscal 2007, we recorded IPR&D charges of $7 million, $45 million and $190 million,

respectively, related to acquisitions. The decrease in IPR&D in fiscal 2009 from fiscal 2008 was due

primarily to higher IPR&D expenses in the prior year as a result of our EDS acquisition in the fourth

quarter of fiscal 2008.

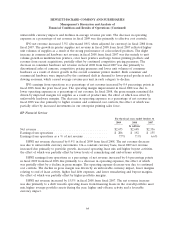

Restructuring

Restructuring charges for fiscal 2009 were $640 million. These charges included $346 million of

severance and facility costs related to our fiscal 2008 restructuring plan, $297 million of severance costs

associated with our fiscal 2009 restructuring plan, and a reduction of $3 million related to adjustments

to other restructuring plans.

Restructuring charges for fiscal 2008 were $270 million, which included $246 million of charges due

primarily to severance and facility costs related to the EDS acquisition and a net charge of $24 million

relating to adjustments for existing restructuring programs.

Restructuring charges for fiscal 2007 were $387 million, which included $354 million of expenses

related to severance and other benefit costs associated with those employees who elected to participate

in the early retirement program implemented in fiscal 2007 and a net charge of $33 million relating to

adjustments to our previous restructuring programs.

54