HP 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

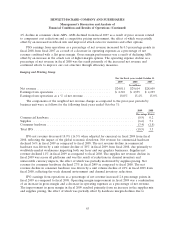

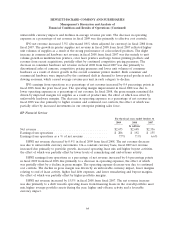

Consolidated Financial Statements in Item 8, which is incorporated herein by reference. Portfolio

assets also include capitalized profit on intercompany equipment transactions of approximately

$700 million at October 31, 2009 and October 31, 2008, and intercompany leases of approximately

$1.0 billion and $800 million at October 31, 2009 and October 31, 2008, both of which are

eliminated in consolidation.

(2) Allowance for doubtful accounts includes both the short-term and the long-term portions of the

allowance on financing receivables.

(3) HPFS debt consists of intercompany equity that is treated as debt for segment reporting purposes,

intercompany debt and debt issued directly by HPFS.

Net portfolio assets at October 31, 2009 increased 20.8% from October 31, 2008. The increase

resulted from higher levels of financing originations in fiscal 2009 and a favorable currency impact. The

overall percentage of portfolio assets reserves remained flat due to continued strong portfolio

performance. HPFS funds its operations mainly through a combination of intercompany debt and

equity. In addition to the balances reflected above, HP assumed net portfolio assets of $51 million

through the acquisition of EDS.

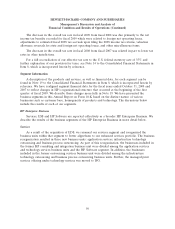

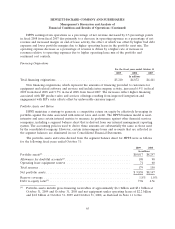

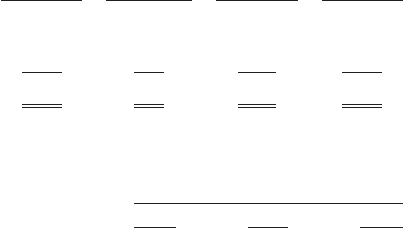

Rollforward of Reserves:

Deductions,

October 31, Additions to net of October 31,

2008 allowance recoveries 2009

In millions

Allowance for doubtful accounts ................. $ 90 $63 $(45) $108

Operating lease equipment reserve ............... 60 19 (8) 71

Total reserve ............................... $150 $82 $(53) $179

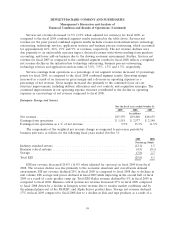

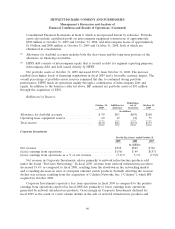

Corporate Investments

For the fiscal years ended October 31

2009 2008 2007

In millions

Net revenue .......................................... $768 $965 $ 762

(Loss) earnings from operations ............................ $(56) $ 49 $(57)

(Loss) earnings from operations as a % of net revenue ........... (7.3)% 5.1% (7.5)%

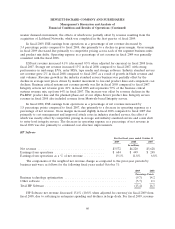

Net revenue in Corporate Investments relates primarily to network infrastructure products sold

under the brand ‘‘ProCurve Networking.’’ In fiscal 2009, revenue from network infrastructure products

decreased 19.6% as compared to fiscal 2008, resulting from the slowdown in the networking market

and a resulting decrease in sales of enterprise ethernet switch products. Partially offsetting the revenue

decline was revenue resulting from the acquisition of Colubris Networks, Inc. (‘‘Colubris’’), which HP

acquired in October 2008.

Corporate Investments reported a loss from operations in fiscal 2009 as compared to the positive

earnings from operations reported in fiscal 2008 due primarily to lower earnings from operations

generated by network infrastructure products. Gross margin in Corporate Investments declined for

fiscal 2009 as the result of a unit volume decline in the sale of network infrastructure products and

66