HP 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

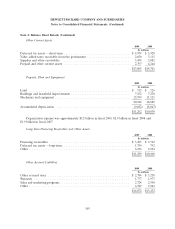

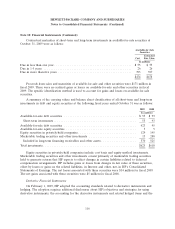

Note 4: Balance Sheet Details (Continued)

Other Liabilities

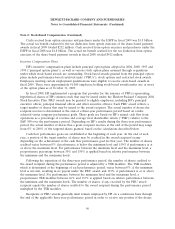

2009 2008

In millions

Pension, post-retirement, and post-employment liabilities .................... $ 6,427 $ 3,712

Deferred tax liability — long-term .................................... 4,230 3,162

Long-term deferred revenue ........................................ 3,249 3,152

Other long-term liabilities .......................................... 3,393 3,748

$17,299 $13,774

Long-term deferred revenue represents service and product deferred revenue to be recognized

after one year from the balance sheet date. Deferred revenue represents amounts received or billed in

advance for fixed-price support or maintenance contracts, software customer support contracts,

outsourcing services start-up or transition work, consulting and integration projects, product sales and

leasing income. The fixed-price support or maintenance contracts include stand-alone product support

packages, routine maintenance service contracts, upgrades or extensions to standard product warranty,

as well as high availability services for complex, global, networked, multi-vendor environments. HP

defers these service amounts at the time HP bills the customer, and HP then recognizes the amounts

ratably over the contract life or as HP renders the services. HP also defers and subsequently amortizes

certain set-up costs related to activities that enable the performance of the customer contract. Deferred

contract costs, including set-up and other unbilled costs, are amortized on a straight-line basis over the

remaining original contract term unless billing patterns indicate a more accelerated method is

appropriate.

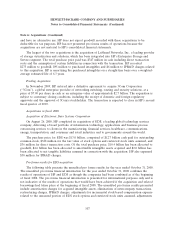

Note 5: Supplemental Cash Flow Information

Supplemental cash flow information to the Consolidated Statements of Cash Flows for the fiscal

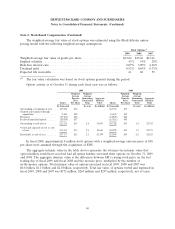

years ended October 31 2009, October 31, 2008 and October 31, 2007 was as follows:

2009 2008 2007

In millions

Cash paid for income taxes, net ................................... $643 $1,136 $956

Cash paid for interest ........................................... $572 $ 426 $489

Non-cash investing and financing activities:

Issuance of common stock and stock awards assumed in business acquisitions . $ — $ 316 $ 41

Purchase of assets under financing arrangements ..................... $283 $ — $ 57

Purchase of assets under capital leases ............................. $131 $ 30 $ —

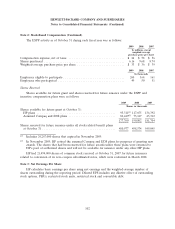

Note 6: Acquisitions

Acquisitions in fiscal 2009

In fiscal 2009, HP completed two acquisitions. Total consideration for the acquisitions was

$390 million, which includes direct transaction costs and the assumption of certain liabilities in

connection with the transactions. HP recorded $315 million of goodwill, $105 million of purchased

intangibles and $7 million of in-process research and development charges (‘‘IPR&D’’) related to these

transactions. Projects that qualify for treatment as IPR&D have not yet reached technical feasibility

106