HP 2009 Annual Report Download - page 91

Download and view the complete annual report

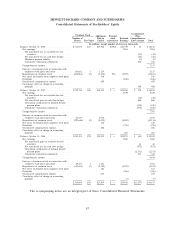

Please find page 91 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 1: Summary of Significant Accounting Policies

Principles of Consolidation

The Consolidated Financial Statements include the accounts of Hewlett-Packard Company, its

wholly-owned subsidiaries and its controlled majority-owned subsidiaries (collectively, ‘‘HP’’). HP

accounts for equity investments in companies over which HP has the ability to exercise significant

influence, but does not hold a controlling interest, under the equity method, and HP records its

proportionate share of income or losses in interest and other, net in the Consolidated Statements of

Earnings. HP has eliminated all significant intercompany accounts and transactions.

Business Combinations

HP has recorded all acquisitions using the purchase method of accounting and, accordingly, has

included the results of operations of acquired businesses in HP’s consolidated results from the date of

each acquisition. HP allocates the purchase price of its acquisitions to the tangible assets, liabilities and

intangible assets acquired, including in-process research and development (‘‘IPR&D’’) charges, based

on their estimated fair values. The excess purchase price over those fair values is recorded as goodwill.

The fair value assigned to assets acquired is based on valuations using management’s estimates and

assumptions.

HP will adopt new accounting standards issued by the Financial Accounting Standards Board

(‘‘FASB’’) for business combinations in the first quarter of fiscal 2010. Changes to the purchase method

of accounting for business combinations are discussed further in Accounting Pronouncements in this

Note.

Reclassifications and Segment Reorganization

Certain reclassifications have been made to prior-year amounts in order to conform to current year

presentation.

HP has made certain organizational realignments in order to optimize its operating structure.

Reclassifications of prior year financial information have been made to conform to the current year

presentation. None of the changes impacts HP’s previously reported consolidated net revenue, earnings

from operations, net earnings or net earnings per share. See Note 19 for a further discussion of HP’s

segment reorganization, which is incorporated herein by reference.

HP has made certain reclassifications of its Consolidated Statements of Earnings for the fiscal

years ended October 31, 2008 and October 31, 2007 to provide improved visibility and comparability

with the current year presentation. This change does not affect previously reported results of operations

for any period presented. Certain pursuit-related costs previously reported as cost of services have been

realigned retroactively to selling, general and administrative expenses due to organizational

realignments.

HP has revised the presentation of its Consolidated Statements of Cash Flows for the fiscal years

ended October 31, 2008 and October 31, 2007 to reflect revisions to the current and deferred tax

provisions in those years related to the presentation of tax benefits of stock option plans, as described

in Note 14. The revisions result in an increase in the change in taxes on earnings and a decrease in the

adjustment to deferred taxes on earnings within cash flows from operating activities on the

Consolidated Statements of Cash Flows. These revisions do not affect previously reported results of

operations, financial position or net cash provided by operating activities for any period presented.

84