HP 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

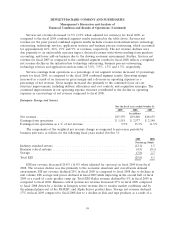

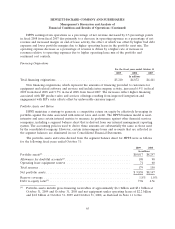

Our key working capital metrics are as follows:

October 31

2009 2008 2007

Days of sales outstanding in accounts receivable ........................... 48 45 43

Days of supply in inventory .......................................... 23 27 34

Days of purchases outstanding in accounts payable(1). ....................... (57) (52) (53)

Cash conversion cycle .............................................. 14 20 24

(1) Beginning in the second quarter of fiscal 2009, we reclassified certain activity within Other accrued

liabilities to Accounts payable as this better represents the nature of the activity. All prior periods

have been revised to conform to the current presentation.

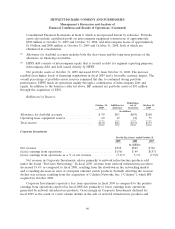

Days of sales outstanding in accounts receivable (‘‘DSO’’) measures the average number of days

our receivables are outstanding. DSO is calculated by dividing ending accounts receivable, net of

allowance for doubtful accounts, by a 90-day average net revenue. Our accounts receivable balance was

$13.4 billion as of October 31, 2007.

Days of supply in inventory (‘‘DOS’’) measures the average number of days from procurement to

sale of our product. DOS is calculated by dividing ending inventory by a 90-day average cost of goods

sold. Our inventory balance was $8.0 billion as of October 31, 2007.

Days of purchases outstanding in accounts payable (‘‘DPO’’) measures the average number of days

our accounts payable balances are outstanding. DPO is calculated by dividing ending accounts payable

by a 90-day average cost of goods sold. Our accounts payable balance was $12.4 billion as of

October 31, 2007.

Our working capital requirements depend upon our effective management of the cash conversion

cycle, which represents effectively the number of days that elapse from the day we pay for the purchase

of raw materials to the collection of cash from our customers. The cash conversion cycle is the sum of

DSO and DOS less DPO.

The cash conversion cycle for fiscal 2009 decreased by 6 days as compared to fiscal 2008. The

increase in DSO was due primarily to our improving penetration into the enterprise market which

tends to have a higher DSO profile, optimizing terms to drive shareholder value as well as more sales

in the month of October. The decrease in DOS was due to lower inventory levels driven primarily by

improved inventory management. The increase in DPO was due primarily to a change in purchasing

linearity in the fourth quarter.

The cash conversion cycle for the fiscal 2008 decreased by 4 days as compared to fiscal 2007. The

increase in DSO was due primarily to a higher accounts receivable balance during the fourth quarter of

fiscal 2008 compared to the same period in fiscal 2007 and the effect of the EDS acquisition. The

decrease in DOS was due primarily to more efficient inventory management, higher cost of goods sold

during the fourth quarter of 2008 as a result of increased revenues and the effect of the EDS

acquisition. The slight decrease in DPO was due to the effect of the EDS acquisition.

Investing Activities

Net cash used in investing activities decreased by approximately $10.1 billion for fiscal 2009 as

compared to fiscal 2008 due primarily to higher cash payments made in connection with fiscal 2008

69