HP 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

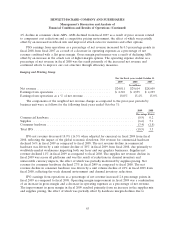

PSG had the most favorable impact to the change in total company gross margin due to the mix

effect of its gross margin representing a smaller component of our total gross margin from levels

experienced in the prior-year period.

PSG gross margin declined in fiscal 2009 from fiscal 2008, resulting from ASPs declining at a faster

pace than component costs combined with a mix shift towards lower-end products, the effects of which

were partially offset by lower warranty and supply chain costs and improvements in the option attach

rate.

Fiscal 2008

Total company gross margin decreased slightly in fiscal 2008 from fiscal 2007. On a segment basis,

an increase in HP Software gross margin and a small increase in ESS gross margin were offset by small

gross margin declines in Services and HPFS and flat gross margin growth across our remaining

segments.

The slight improvement in ESS gross margin in fiscal 2008 from the prior year was primarily a

result of improved cost management and attach rates in industry standard servers.

Services gross margin declined in fiscal 2008 from the prior year due primarily to the impact from

the continued competitive pricing environment, partially offset by the continued focus on cost structure

improvements generated by delivery efficiencies and cost controls.

For fiscal 2008 as compared to fiscal 2007, the improvement in HP Software gross margin was

primarily the result of cost savings in the BTO business unit.

HPFS gross margin declined slightly in fiscal 2008 due primarily to higher bad debt expenses, the

effect of which was partially offset by increased margins on end-of-lease activity.

IPG gross margin remained flat in fiscal 2008 as compared to fiscal 2007 with improved supplies

margins resulting from mix shifts being offset by unfavorable hardware margins.

In fiscal 2008, PSG gross margin remained flat due primarily to declining ASPs offset by an

increase in the attach rate of higher-margin options.

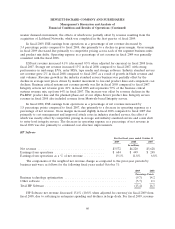

Operating Expenses

Research and Development

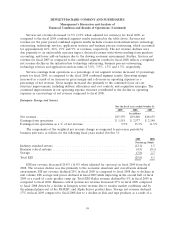

Total research and development (‘‘R&D’’) expense decreased in fiscal 2009 as compared to fiscal

2008 due primarily to favorable currency impacts related to the movement of the dollar against the

euro, as well as effective cost controls, the effect of which was partially offset by additional expenses

related primarily to Services. In fiscal 2009, R&D expense as a percentage of net revenue decreased for

ESS, PSG, and IPG, and increased for HP Software, Services and Corporate Investments.

Total R&D decreased in fiscal 2008 as compared to fiscal 2007, due primarily to effective cost

controls, the impact of which was partially offset by the unfavorable currency impacts related to the

movement of the dollar against the euro. Each of our major segments experienced a year-over-year

decrease in R&D expense as a percentage of net revenue in fiscal 2008.

53