HP 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

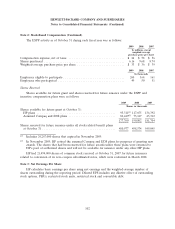

Note 7: Goodwill and Purchased Intangible Assets (Continued)

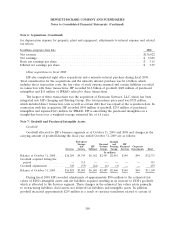

Estimated future amortization expense related to finite lived purchased intangible assets at

October 31, 2009 is as follows:

Fiscal year: In millions

2010 ................................................................ $1,308

2011 ................................................................ 1,053

2012 ................................................................ 855

2013 ................................................................ 717

2014 ................................................................ 464

Thereafter ............................................................ 781

Total ................................................................ $5,178

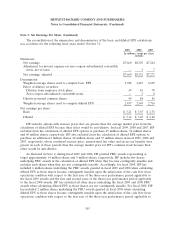

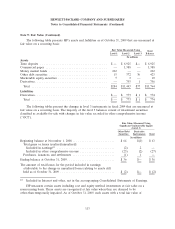

Note 8: Restructuring Charges

Fiscal 2009 Restructuring Plan

In May 2009, HP’s management approved and initiated a restructuring plan to structurally change

and improve the effectiveness of the Imaging and Printing Group (‘‘IPG’’), the Personal Systems Group

(‘‘PSG’’), and Enterprise Storage and Servers (‘‘ESS’’). In fiscal 2009, HP recorded a net charge of

$297 million in severance-related costs associated with the planned elimination of approximately

5,000 positions. As of October 31, 2009, approximately 2,100 positions have been eliminated. HP

expects the majority of the restructuring costs to be paid out by the fourth quarter of fiscal 2010. In

future quarters, HP expects to record an additional charge of approximately $6 million related to

severance costs associated with this plan.

Fiscal 2008 HP/EDS Restructuring Plan

In connection with the acquisition of EDS on August 26, 2008, HP’s management approved and

initiated a restructuring plan to streamline the combined company’s services business and to better

align the structure and efficiency of that business with HP’s operating model. The restructuring plan is

expected to be implemented over four years from the acquisition date and includes changes to the

combined company’s workforce as well as changes to corporate overhead functions such as real estate

and IT.

In the fourth quarter of fiscal 2008, HP recorded a liability of approximately $1.8 billion related to

this restructuring plan. Approximately $1.5 billion of the liability was associated with pre-acquisition

EDS and was recorded to goodwill, and the remaining approximately $0.3 billion was associated with

HP and was recorded as a restructuring charge. The liability consisted mainly of severance costs to

eliminate approximately 25,000 positions, costs to vacate duplicative facilities and costs associated with

early termination of certain contractual obligations. HP recorded net charges for severance and

facilities costs of $346 million, for the twelve months ended October 31, 2009, along with year-to-date

adjustments to goodwill of $276 million. As of October 31, 2009, over 19,000 positions have been

eliminated.

HP expects the majority of the restructuring costs to be paid out by the second quarter of fiscal

2010. In future quarters, HP expects to record an additional charge of approximately $465 million

related to the cost to vacate duplicative facilities and severance costs.

110