HP 2009 Annual Report Download - page 124

Download and view the complete annual report

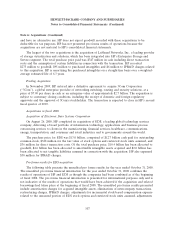

Please find page 124 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

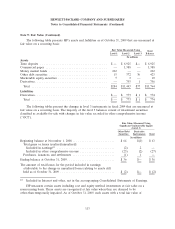

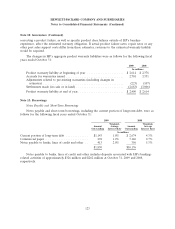

Note 10: Financial Instruments (Continued)

effect of derivative instruments and related hedged items on the financial statements. The adoption had

no financial impact on the consolidated financial statements.

HP is a global company that is exposed to foreign currency exchange rate fluctuations and interest

rate changes in the normal course of its business. As part of its risk management strategy, HP uses

derivative instruments, primarily forward contracts, option contracts, interest rate swaps, and total

return swaps, to hedge certain foreign currency, interest rate and, to a lesser extent, equity exposures.

HP’s objective is to offset gains and losses resulting from these exposures with losses and gains on the

derivative contracts used to hedge them, thereby reducing volatility of earnings or protecting fair values

of assets and liabilities. HP does not have any leveraged derivatives. HP does not use derivative

contracts for speculative purposes. HP designates its derivatives as fair value hedges, cash flow hedges

or hedges of the foreign currency exposure of a net investment in a foreign operation (‘‘net investment

hedges’’). Additionally, for derivatives not designated as hedging instruments, HP categorizes those

economic hedges as other derivatives. HP recognizes all derivatives in the Consolidated Balance Sheets

at fair value and reports them in Other current assets, Long-term financing receivables and other

assets, Other accrued liabilities, or Other liabilities. HP classifies cash flows from the derivative

programs as operating activities in the Consolidated Statement of Cash Flows.

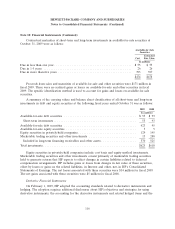

As a result of the use of derivative instruments, HP is exposed to the risk that counterparties to

derivative contracts will fail to meet their contractual obligations. To mitigate the counterparty credit

risk, HP has a policy of only entering into contracts with carefully selected major financial institutions

based upon their credit ratings and other factors, and HP maintains dollar and term limits that

correspond to each institution’s credit rating. HP’s established policies and procedures for mitigating

credit risk on principal transactions and short-term cash include reviewing and establishing limits for

credit exposure and continually assessing the creditworthiness of counterparties. Master agreements

with counterparties include master netting arrangements as further mitigation of credit exposure to

counterparties. These arrangements permit HP to net amounts due from HP to a counterparty with

amounts due to HP from a counterparty, which reduces the maximum loss from credit risk in the event

of counterparty default.

Certain of HP’s derivative instruments contain credit-risk-related contingent features, such as a

provision whereby the counterparties to the derivative instruments could request collateralization on

derivative instruments in net liability positions if HP’s credit rating falls below investment grade. As of

October 31, 2009, HP was not required to post any collateral, and HP did not have any derivative

instruments with credit-risk-related contingent features that were in a significant net liability position.

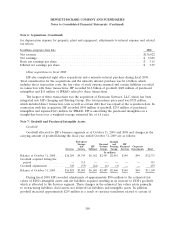

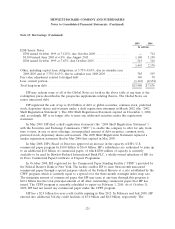

Fair Value Hedges

HP enters into fair value hedges to reduce the exposure of its debt portfolio to interest rate risk.

HP issues long-term debt in U.S. dollars based on market conditions at the time of financing. HP uses

interest rate swaps to modify the market risk exposures in connection with the debt to achieve primarily

U.S. dollar LIBOR-based floating interest expense. The swap transactions generally involve principal

and interest obligations for U.S. dollar-denominated amounts. Alternatively, HP may choose not to

swap fixed for floating interest payments or may terminate a previously executed swap if it believes a

larger proportion of fixed-rate debt would be beneficial. When investing in fixed-rate instruments, HP

may enter into interest rate swaps that convert the fixed interest returns into variable interest returns

and would classify these swaps as fair value hedges. For derivative instruments that are designated and

117