HP 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 16: Retirement and Post-Retirement Benefit Plans (Continued)

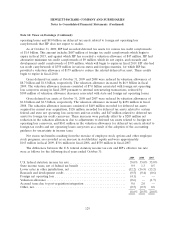

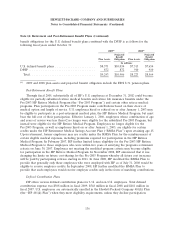

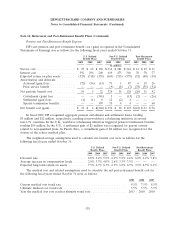

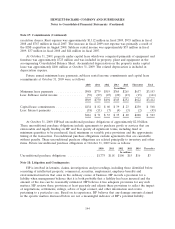

Pension and Post-Retirement Benefit Expense

HP’s net pension and post-retirement benefit cost (gain) recognized in the Consolidated

Statements of Earnings was as follows for the following fiscal years ended October 31:

U.S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

2009 2008 2007 2009 2008 2007 2009 2008 2007

In millions

Service cost ...................... $ 27 $ 63 $130 $312 $281 $261 $14 $29 $31

Interest cost ...................... 592 296 260 619 475 366 70 78 77

Expected return on plan assets ........ (533) (318) (355) (669) (713) (579) (32) (40) (38)

Amortization and deferrals:

Actuarial (gain) loss ............... (72) (36) (13) 71 1 87 6 19 26

Prior service benefit ............... — — — (9) (8) (7) (78) (55) (54)

Net periodic benefit cost ............. 14 5 22 324 36 128 (20) 31 42

Curtailment (gain) loss ............ — — (541) 5 — (13) (2) — (26)

Settlement (gain) loss ............. (1) (1) 8 12 (2) 4———

Special termination benefits ......... — — 307 55 4 4——60

Net benefit cost (gain) .............. $ 13 $ 4 $(204) $ 396 $ 38 $ 123 $(22) $ 31 $ 76

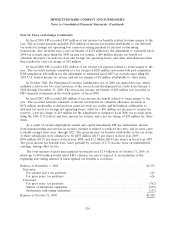

In fiscal 2009, HP recognized aggregate pension curtailment and settlement losses totaling

$5 million and $12 million, respectively, resulting from workforce rebalancing initiatives in several

non-U.S. countries. In the U.K., workforce rebalancing initiatives triggered pension termination benefits

totaling $55 million. In the U.S., a settlement gain of $1 million was recognized for payout activity

related to non-qualified plans. In Puerto Rico, a curtailment gain of $2 million was recognized for the

closure of the retiree medical plan.

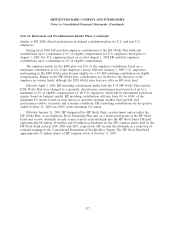

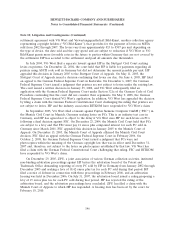

The weighted-average assumptions used to calculate net benefit cost were as follows for the

following fiscal years ended October 31:

U.S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

2009 2008 2007 2009 2008 2007 2009 2008 2007

Discount rate ........................... 8.0% 6.4% 5.9% 6.0% 5.2% 4.4% 8.2% 6.2% 5.8%

Average increase in compensation levels ....... 2.0% 3.7% 4.0% 2.6% 3.3% 3.3% — — —

Expected long-term return on assets .......... 7.5% 6.7% 8.3% 6.9% 6.8% 6.7% 9.3% 8.7% 8.3%

The medical cost and related assumptions used to calculate the net post-retirement benefit cost for

the following fiscal years ended October 31 were as follows:

2009 2008 2007

Current medical cost trend rate .................................... 9.5% 7.5% 8.5%

Ultimate medical cost trend rate ................................... 5.5% 5.5% 5.5%

Year the medical cost rate reaches ultimate trend rate .................... 2013 2010 2010

138