HP 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

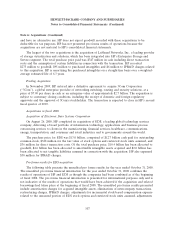

Note 6: Acquisitions (Continued)

for depreciation expense for property, plant and equipment, adjustments to interest expense and related

tax effects.

In millions, except per share data 2008

Net revenue ........................................................... $136,022

Net earnings .......................................................... $ 7,828

Basic net earnings per share ............................................... $ 3.15

Diluted net earnings per share ............................................. $ 3.05

Other acquisitions in fiscal 2008

HP also completed eight other acquisitions and a minority interest purchase during fiscal 2008.

Total consideration for the acquisitions and the minority interest purchase was $1.6 billion, which

includes direct transaction costs, the fair value of stock options assumed and certain liabilities recorded

in connection with these transactions. HP recorded $1.0 billion of goodwill, $600 million of purchased

intangibles and $15 million of IPR&D related to these transactions.

The largest of these transactions was the acquisition of Exstream Software, LLC, which has been

integrated into HP’s Imaging and Printing Group. The total purchase price paid was $720 million,

which included direct transaction costs as well as certain debt that was repaid at the acquisition date. In

connection with this acquisition, HP recorded $434 million of goodwill, $235 million of purchased

intangibles and expensed $11 million for IPR&D. HP is amortizing the purchased intangibles on a

straight-line basis over a weighted-average estimated life of 6.8 years.

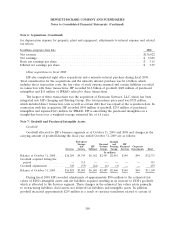

Note 7: Goodwill and Purchased Intangible Assets

Goodwill

Goodwill allocated to HP’s business segments as of October 31, 2009 and 2008 and changes in the

carrying amount of goodwill during the fiscal year ended October 31, 2009 are as follows:

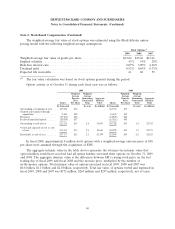

Enterprise Imaging

Storage Personal and HP

and HP Systems Printing Financial Corporate

Services Servers Software Group Group Services Investments Total

In millions

Balance at October 31, 2008 ..... $16,284 $4,745 $6,162 $2,493 $2,463 $144 $44 $32,335

Goodwill acquired during the

period .................. — 315 — — — — — 315

Goodwill adjustments ......... 545 (55) (22) (6) (3) — — 459

Balance at October 31, 2009 ..... $16,829 $5,005 $6,140 $2,487 $2,460 $144 $44 $33,109

During fiscal 2009, HP recorded adjustments of approximately $306 million to the estimated fair

values of EDS’s intangible assets and net liabilities acquired resulting in an increase to EDS’s goodwill,

which is allocated to the Services segment. These changes in the estimated fair values relate primarily

to restructuring liabilities, fixed assets, net deferred tax liabilities and intangible assets. In addition,

goodwill increased approximately $255 million as a result of currency translation related to certain of

108