HP 2009 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

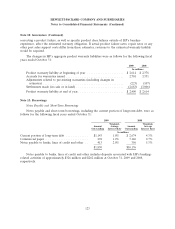

Note 14: Taxes on Earnings (Continued)

In fiscal 2009, HP recorded $547 million of net income tax benefits related to items unique to the

year. The recorded amounts included $383 million of income tax benefits attributable to net deferred

tax assets for foreign net operating loss carryovers arising pursuant to internal restructuring

transactions. Also included were a net tax benefit of $154 million for the adjustment to estimated fiscal

2008 tax accruals upon filing the 2008 income tax returns, a $60 million income tax benefit for

valuation allowance reversals for state and foreign net operating losses, and other miscellaneous items

that resulted in a net tax charge of $50 million.

In fiscal 2008, HP recorded $251 million of net income tax expense related to items unique to the

year. The recorded amounts consisted of a tax charge of $205 million associated with post-acquisition

EDS integration, $44 million for the adjustment to estimated fiscal 2007 tax accruals upon filing the

2007 U.S. federal income tax return, and net tax charges of $2 million attributable to other items.

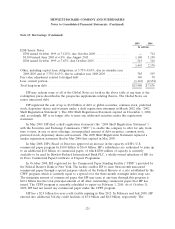

In October 2008, the Emergency Economic Stabilization Act of 2008 was signed into law, which

included a retroactive two year extension of the research and development tax credit from January 1,

2008 through December 31, 2009. The retroactive income tax benefit of $45 million was recorded in

HP’s financial statements in the fourth quarter of fiscal 2008.

In fiscal 2007, HP recorded $80 million of net income tax benefit related to items unique to the

year. The recorded amounts consisted of income tax benefits for valuation allowance reversals of

$154 million attributable to deferred tax assets for state tax credits and $60 million attributable to

deferred tax assets for foreign net operating losses, offset by a $96 million net increase to various tax

reserves, a net tax charge of $18 million for the adjustment to estimated fiscal 2006 tax accruals upon

filing the 2006 U.S. federal and state income tax returns, and a net tax charge of $20 million for other

items.

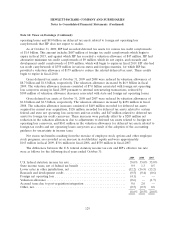

As a result of certain employment actions and capital investments HP has undertaken, income

from manufacturing and services in certain countries is subject to reduced tax rates, and in some cases

is wholly exempt from taxes, through 2022. The gross income tax benefits attributable to the tax status

of these subsidiaries were estimated to be $853 million ($0.35 per share) in fiscal year 2009,

$900 million ($0.35 per share) in fiscal year 2008, and $1.2 billion ($0.43 per share) in fiscal year 2007.

The gross income tax benefits were offset partially by accruals of U.S. income taxes on undistributed

earnings, among other factors.

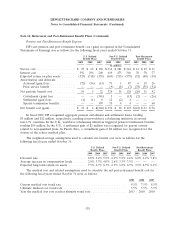

The total amount of gross unrecognized tax benefits was $1.9 billion as of October 31, 2009, of

which up to $950 million would affect HP’s effective tax rate if realized. A reconciliation of the

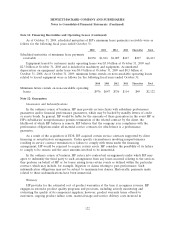

beginning and ending amount of unrecognized tax benefits is as follows:

Balance at November 1, 2008 ................................................ $2,333

Increases:

For current year’s tax positions ........................................... 115

For prior years’ tax positions ............................................. 626

Decreases:

For prior years’ tax positions ............................................. (762)

Statute of limitations expiration ........................................... (293)

Settlements with taxing authorities ......................................... (131)

Balance at October 31, 2009 ................................................. $1,888

130