HP 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

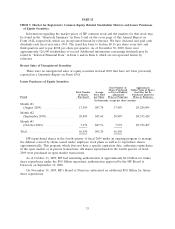

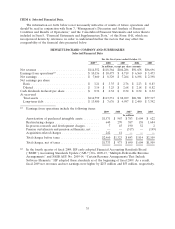

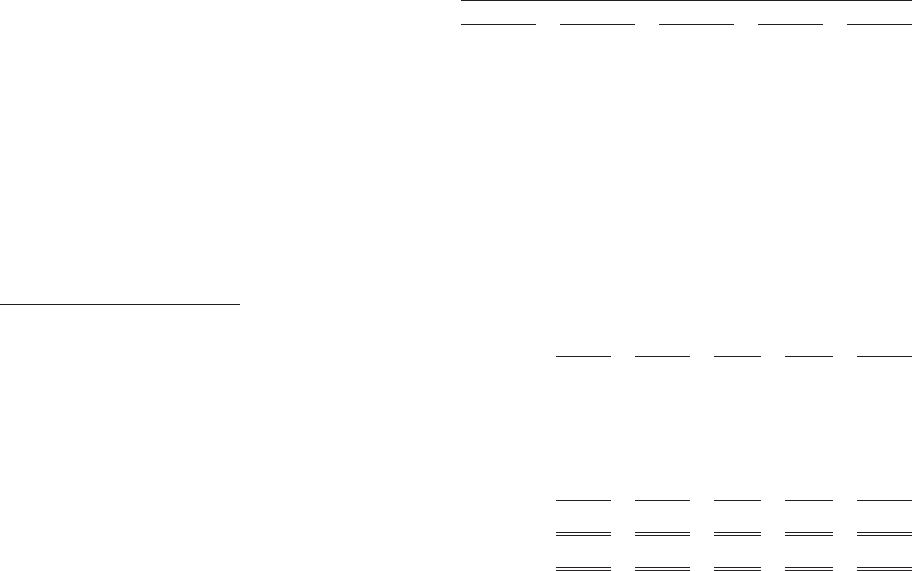

ITEM 6. Selected Financial Data.

The information set forth below is not necessarily indicative of results of future operations and

should be read in conjunction with Item 7, ‘‘Management’s Discussion and Analysis of Financial

Condition and Results of Operations,’’ and the Consolidated Financial Statements and notes thereto

included in Item 8, ‘‘Financial Statements and Supplementary Data,’’ of this Form 10-K, which are

incorporated herein by reference, in order to understand further the factors that may affect the

comparability of the financial data presented below.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Selected Financial Data

For the fiscal years ended October 31,

2009(2) 2008 2007 2006 2005

In millions, except per share amounts

Net revenue ........................... $114,552 $118,364 $104,286 $91,658 $86,696

Earnings from operations(1) ................ $ 10,136 $ 10,473 $ 8,719 $ 6,560 $ 3,473

Net earnings ........................... $ 7,660 $ 8,329 $ 7,264 $ 6,198 $ 2,398

Net earnings per share

Basic ............................... $ 3.21 $ 3.35 $ 2.76 $ 2.23 $ 0.83

Diluted ............................. $ 3.14 $ 3.25 $ 2.68 $ 2.18 $ 0.82

Cash dividends declared per share ........... $ 0.32 $ 0.32 $ 0.32 $ 0.32 $ 0.32

At year-end:

Total assets .......................... $114,799 $113,331 $ 88,699 $81,981 $77,317

Long-term debt ....................... $ 13,980 $ 7,676 $ 4,997 $ 2,490 $ 3,392

(1) Earnings from operations include the following items:

2009 2008 2007 2006 2005

In millions

Amortization of purchased intangible assets ......... $1,571 $ 967 $ 783 $ 604 $ 622

Restructuring charges ......................... 640 270 387 158 1,684

In-process research and development charges ........ 7 45 190 52 2

Pension curtailments and pension settlements, net . . . . — — (517) — (199)

Acquisition-related charges ..................... 242 41 — — —

Total charges before taxes ...................... $2,460 $1,323 $ 843 $ 814 $2,109

Total charges, net of taxes ...................... $1,733 $ 973 $ 690 $ 604 $1,509

(2) In the fourth quarter of fiscal 2009, HP early adopted Financial Accounting Standards Board

(‘‘FASB’’) Accounting Standards Update (‘‘ASU’’) No. 2009-13, ‘‘Multiple-Deliverable Revenue

Arrangements’’ and FASB ASU No. 2009-14, ‘‘Certain Revenue Arrangements That Include

Software Elements.’’ HP adopted these standards as of the beginning of fiscal 2009. As a result,

fiscal 2009 net revenues and net earnings were higher by $255 million and $55 million, respectively.

35