HP 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

unfavorable currency impacts and declines in average revenue per unit. The decrease in operating

expenses as a percentage of net revenue in fiscal 2009 was due primarily to effective cost controls.

IPG net revenue increased 3.5% (decreased 0.8% when adjusted for currency) in fiscal 2008 from

fiscal 2007. The growth in printer supplies net revenue in fiscal 2008 from fiscal 2007 reflected higher

unit volumes of supplies as a result of the strong performance of color-related products. The slight

increase in commercial hardware net revenue in fiscal 2008 from fiscal 2007 was due mainly to unit

volume growth in multifunction printers, color laser printers and large format printing products and

revenue from recent acquisitions, partially offset by continued competitive pricing pressures. The

decrease in consumer hardware net revenue in fiscal 2008 from fiscal 2007 was due primarily to

discontinued sales of cameras, competitive pricing pressures and lower unit volumes of consumer

hardware as a result of slower growth in the overall consumer printer market. Both consumer and

commercial hardware were impacted by the continued shift in demand to lower-priced products and a

slowing economy, which caused average revenue per unit in each category to decline.

IPG earnings from operations as a percentage of net revenue increased by 0.4 percentage points in

fiscal 2008 from the prior fiscal year. The operating margin improvement in fiscal 2008 was due to

lower operating expenses as a percentage of net revenue. In fiscal 2008, the gross margin remained flat

driven by improved margins for supplies as a result of product mix, the effect of which was offset by

unfavorable hardware margins. The decrease in operating expenses as a percentage of net revenue in

fiscal 2008 was due primarily to higher revenue and continued cost controls, the effect of which was

partially offset by increased investments in our enterprise printing sales force.

HP Financial Services

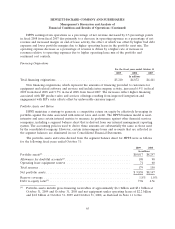

For the fiscal years ended October 31

2009 2008 2007

In millions

Net revenue ........................................ $2,673 $2,698 $2,336

Earnings from operations .............................. $ 206 $ 192 $ 155

Earnings from operations as a % of net revenue ............. 7.7% 7.1% 6.6%

HPFS net revenue decreased by 0.9% in fiscal 2009 from fiscal 2008. The net revenue decrease

was due to unfavorable currency movements. On a constant currency basis, fiscal 2009 net revenue

increased due primarily to portfolio growth, increased operating lease mix and higher buyout activities,

the effect of which was partially offset by lower levels of remarketing and end-of-lease activity.

HPFS earnings from operations as a percentage of net revenue increased by 0.6 percentage points

in fiscal 2009 from fiscal 2008 due primarily to a decrease in operating expenses, the effect of which

was partially offset by a decline in gross margin. The operating expense decrease was due to continued

cost controls. The decline in gross margin was driven by an unfavorable currency impact, lower margins

relating to end of lease activity, higher bad debt expenses, and lower remarketing and buyout margins,

the effect of which was partially offset by higher portfolio margins.

HPFS net revenue increased by 15.5% in fiscal 2008 from fiscal 2007. The net revenue increase

was due primarily to a shift towards operating leases from financing leases in the overall portfolio asset

mix, higher average portfolio assets during the year, higher end-of-lease activity and a favorable

currency impact.

64