HP 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

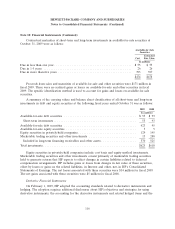

Note 10: Financial Instruments (Continued)

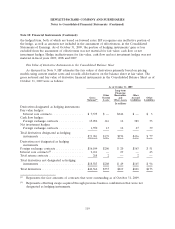

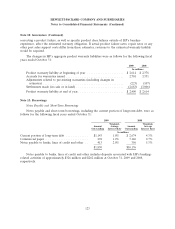

Contractual maturities of short-term and long-term investments in available-for-sale securities at

October 31, 2009 were as follows:

Available-for-Sale

Securities

Estimated

Cost Fair Value

In millions

Due in less than one year ............................................ $ 55 $ 55

Due in 1-5 years .................................................. 26 26

Due in more than five years .......................................... 393 397

$474 $478

Proceeds from sales and maturities of available-for-sale and other securities were $171 million in

fiscal 2009. There were no realized gains or losses on available-for-sale and other securities in fiscal

2009. The specific identification method is used to account for gains and losses on available-for-sale

securities.

A summary of the carrying values and balance sheet classification of all short-term and long-term

investments in debt and equity securities at the following fiscal years ended October 31 was as follows:

2009 2008

In millions

Available-for-sale debt securities ......................................... $ 55 $ 93

Short-term investments ............................................... 55 93

Available-for-sale debt securities ......................................... 423 95

Available-for-sale equity securities ........................................ 5 5

Equity securities in privately-held companies ................................. 129 145

Marketable trading securities and other investments ........................... 13 280

Included in long-term financing receivables and other assets .................... 570 525

Total investments ..................................................... $625 $618

Equity securities in privately-held companies include cost basis and equity method investments.

Marketable trading securities and other investments consist primarily of marketable trading securities

held to generate returns that HP expects to offset changes in certain liabilities related to deferred

compensation arrangements. HP includes gains or losses from changes in fair value of these securities,

offset by losses or gains on the related liabilities, in Interest and other, net, in HP’s Consolidated

Statements of Earnings. The net losses associated with these securities were $14 million for fiscal 2009.

The net gains associated with these securities were $5 million for fiscal 2008.

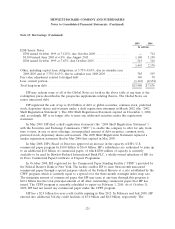

Derivative Financial Instruments

On February 1, 2009, HP adopted the accounting standards related to derivative instruments and

hedging. The adoption requires additional disclosures about HP’s objectives and strategies for using

derivative instruments, the accounting for the derivative instruments and related hedged items and the

116