HP 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

weaker demand environment, the effects of which were partially offset by revenue resulting from the

acquisition of Lefthand Networks, which was completed in the first quarter of fiscal 2009.

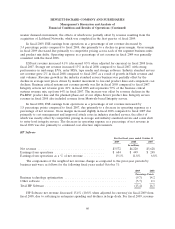

In fiscal 2009, ESS earnings from operations as a percentage of net revenue decreased by

3.4 percentage points compared to fiscal 2008, due primarily to a decline in gross margin. Gross margin

in fiscal 2009 decreased due primarily to competitive pricing across each of the segment business units

and product mix shifts. Operating expense as a percentage of net revenue in fiscal 2009 was generally

consistent with the fiscal 2008.

ESS net revenue increased 4.1% (decreased 0.5% when adjusted for currency) in fiscal 2008 from

fiscal 2007. Storage net revenue increased 13% in fiscal 2008 compared to fiscal 2007, with strong

performance in mid-range EVA, entry MSA, tape media and storage software. Industry standard servers

net revenue grew 2% in fiscal 2008 compared to fiscal 2007 as a result of growth in blade revenue and

unit volumes. Revenue growth in the industry standard servers business was partially offset by the

decline in average unit prices driven by market movement to low-end product lines and component cost

declines. Business critical systems net revenue growth was flat in fiscal 2008 compared to fiscal 2007.

Integrity servers net revenue grew 22% in fiscal 2008 and represents 79% of the business critical

systems revenue mix, up from 64% in fiscal 2007. The increase was offset by revenue declines in the

PA-RISC product line and the planned phase-out of our Alpha Server product line. Integrity servers

revenue in fiscal 2008 also included revenue from Montvale-based Integrity servers.

In fiscal 2008, ESS earnings from operations as a percentage of net revenue increased by

1.8 percentage points compared to fiscal 2007, due primarily to a decrease in operating expenses as a

percentage of net revenue. Gross margin increased slightly in fiscal 2008 compared to fiscal 2007 due

primarily to cost management and improved attach rates in industry standard servers, the effect of

which was mostly offset by competitive pricing in storage and industry standard servers and a mix shift

to entry level integrity servers. The decrease in operating expense as a percentage of net revenue in

fiscal 2008 was due primarily to continued cost structure improvements.

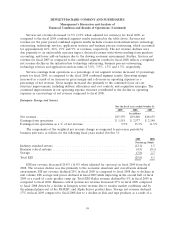

HP Software

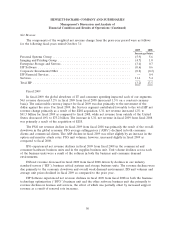

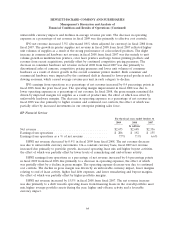

For the fiscal years ended October 31

2009 2008 2007

In millions

Net revenue ...................................... $3,572 $4,220 $3,628

Earnings from operations ............................ $ 684 $ 499 $ 248

Earnings from operations as a % of net revenue ............ 19.1% 11.8% 6.8%

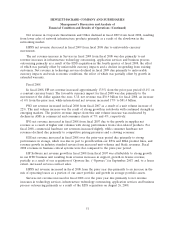

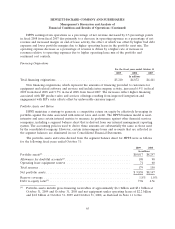

The components of the weighted net revenue change as compared to the prior-year periods by

business unit were as follows for the following fiscal years ended October 31:

2009 2008

Percentage Points

Business technology optimization ................................... (9.7) 14.2

Other software ................................................ (5.7) 2.1

Total HP Software .............................................. (15.4) 16.3

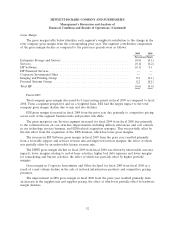

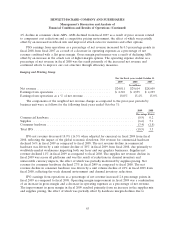

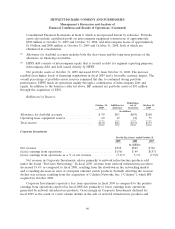

HP Software net revenue decreased 15.4% (10.8% when adjusted for currency) in fiscal 2009 from

fiscal 2008, due to softening in enterprise spending and declines in large deals. For fiscal 2009, revenue

60