HP 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 14: Taxes on Earnings (Continued)

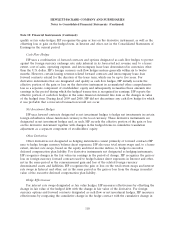

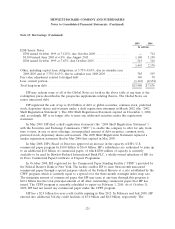

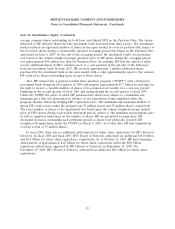

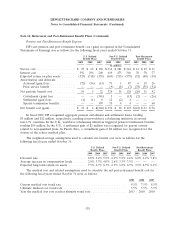

The significant components of deferred tax assets and deferred tax liabilities were as follows for

the following fiscal years ended October 31:

2009 2008

Deferred Deferred Deferred Deferred

Tax Ta x Tax Ta x

Assets Liabilities Assets Liabilities

In millions

Loss carryforwards ................................ $ 9,191 $ 1,753 $ —

Credit carryforwards .............................. 1,444 — 1,549 —

Unremitted earnings of foreign subsidiaries .............. — 7,555 — 5,683

Inventory valuation ............................... 111 6 169 6

Intercompany transactions — profit in inventory .......... 534 16 553 —

Intercompany transactions — excluding inventory ......... 1,328 — 324 —

Fixed assets ..................................... 119 9 152 8

Warranty ....................................... 794 38 793 —

Employee and retiree benefits ....................... 2,692 80 1,955 123

Accounts receivable allowance ....................... 300 4 299 3

Capitalized research and development .................. 879 — 1,192 —

Purchased intangible assets .......................... 28 1,594 30 1,961

Restructuring .................................... 459 17 596 —

Equity investments ................................ 81 — 70 —

Deferred revenue ................................ 949 12 918 —

Other ......................................... 1,599 82 768 83

Gross deferred tax assets and liabilities ................. 20,508 9,413 11,121 7,867

Valuation allowance ............................... (8,678) — (1,801) —

Total deferred tax assets and liabilities ................. $11,830 $9,413 $ 9,320 $7,867

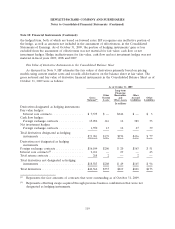

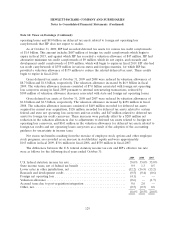

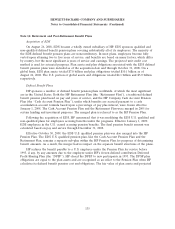

The breakdown between current and long-term deferred tax assets and deferred tax liabilities was

as follows for the following fiscal years ended October 31:

2009 2008

In millions

Current deferred tax assets .......................................... $4,979 $ 3,920

Current deferred tax liabilities ....................................... (83) (97)

Long-term deferred tax assets ........................................ 1,751 792

Long-term deferred tax liabilities ..................................... (4,230) (3,162)

Total deferred tax assets net of deferred tax liabilities ...................... $2,417 $ 1,453

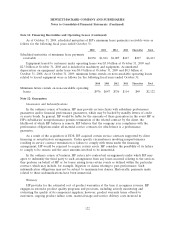

As of October 31, 2009, HP had $1.0 billion, $3.5 billion and $30.5 billion of federal, state and

foreign net operating loss carryforwards, respectively. Amounts included in each of these respective

totals begin to expire in fiscal 2010. Of the $30.5 billion of foreign net operating losses, $24.1 billion

relates to foreign losses arising in fiscal 2009 pursuant to internal restructuring transactions. HP has

provided a valuation allowance of $218 million for deferred tax assets related to federal and state net

128