HP 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

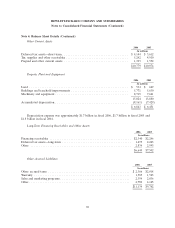

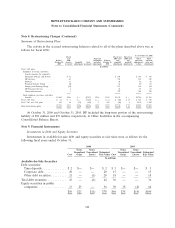

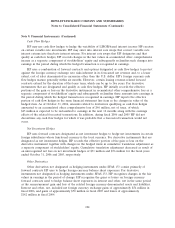

Note 4: Balance Sheet Details (Continued)

Other Liabilities

2006 2005

In millions

Pension, post-retirement, and post-employment liabilities ..................... $2,099 $2,515

Long-term deferred revenue .......................................... 1,750 1,331

Other long-term liabilities ............................................ 1,648 1,443

$5,497 $5,289

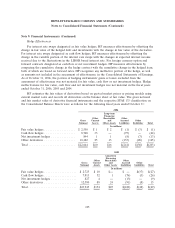

Note 5: Supplemental Cash Flow Information

Supplemental cash flow information was as follows for the following fiscal years ended October 31:

2006 2005 2004

In millions

Cash paid for income taxes, net ..................................... $637 $884 $609

Cash paid for interest ............................................ $299 $447 $305

Non-cash investing and financing activities:

Net issuances of restricted stock and other employee stock benefits ......... $ 40 $137 $ 68

Issuance of common stock and options assumed in business acquisitions ...... $ 13 $ 12 $ 15

Purchase of assets under capital leases .............................. $ 19 $ — $ —

Note 6: Acquisitions

HP has recorded acquisitions using the purchase method of accounting and, accordingly, included

the results of operations in HP’s consolidated results as of the date of each acquisition. HP allocates

the purchase price of its acquisitions to the tangible assets, liabilities and intangible assets acquired,

including in-process research and development (‘‘IPR&D’’), based on their estimated fair values. The

excess purchase price over those fair values is recorded as goodwill. The fair value assigned to assets

acquired is based on valuations using management’s estimates and assumptions. HP does not expect

goodwill recorded on a majority of these acquisitions to be deductible for tax purposes.

Peregrine

On December 19, 2005, HP acquired the outstanding shares of Peregrine Systems, Inc.

(‘‘Peregrine’’) in a cash merger for $26.08 per share. The purchase price was approximately

$538 million, consisting of $442 million of cash paid, which includes direct transaction costs, as well as

the assumption of certain liabilities in connection with the transaction. The acquisition of Peregrine

adds key asset and service management components to the HP OpenView portfolio, a distributed

management software suite for business operations and IT. In connection with this acquisition, HP

recorded approximately $342 million of goodwill and $162 million of amortizable intangible assets. HP

also expensed $34 million for IPR&D. HP is amortizing the purchased intangibles, principally customer

relationships and developed technology, on a straight-line basis over their estimated useful lives ranging

from five to six years.

95