HP 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

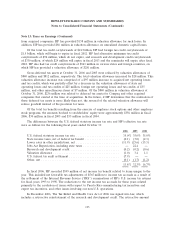

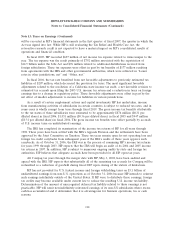

Note 13: Taxes on Earnings (Continued)

American Jobs Creation Act of 2004—Repatriation of Foreign Earnings

The American Jobs Creation Act of 2004 (‘‘the Jobs Act’’), enacted on October 22, 2004, provided

for a temporary 85% dividends received deduction on certain foreign earnings repatriated during a

one-year period. The deduction resulted in an approximate 5.25% federal tax rate on the repatriated

earnings. During the third quarter of fiscal 2005, HP’s CEO and Board of Directors approved a

domestic reinvestment plan as required by the Jobs Act to repatriate $14.5 billion in foreign earnings in

fiscal 2005.

HP recorded tax expense in fiscal 2005 of $792 million related to this $14.5 billion dividend under

the Jobs Act. The additional tax expense consists of federal taxes of $744 million, state taxes, net of

federal benefits, of $73 million, and a net tax benefit of $25 million related to an adjustment of

deferred tax liabilities on both repatriated and unrepatriated foreign earnings.

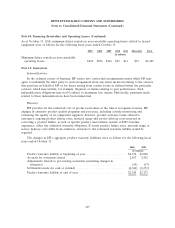

Note 14: Stockholders’ Equity

Dividends

The stockholders of HP common stock are entitled to receive dividends when and as declared by

HP’s Board of Directors. Dividends are paid quarterly. Dividends were $0.32 per common share in

each of fiscal 2006, 2005 and 2004.

Stock Repurchase Program

HP’s share repurchase program authorizes both open market and private repurchase transactions.

In fiscal 2006, HP completed share repurchases of approximately 188 million shares. Approximately

190 million shares were settled for $6.1 billion, which included 2 million shares repurchased in

transactions that were executed in fiscal 2005 but settled in fiscal 2006. In fiscal 2005, HP completed

share repurchases of approximately 150 million shares, of which approximately 148 million shares were

settled for $3.5 billion. In fiscal 2004, HP completed share repurchases of approximately 172 million

shares for $3.3 billion. Shares repurchased and settled in fiscal 2006 were all open market repurchases.

Shares repurchased and settled in fiscal 2005 included open market repurchases of 37 million shares for

$1.0 billion and 111 million shares for $2.5 billion from the David and Lucile Packard Foundation (the

‘‘Packard Foundation’’). Shares repurchased and settled in fiscal 2004 included open market

repurchases of 66 million shares for $1.3 billion, 72 million shares for $1.3 billion under an accelerated

share repurchase program with an investment bank (the ‘‘Accelerated Purchase’’) and 34 million shares

for $679 million from the Packard Foundation.

In addition to the above transactions, HP entered into a prepaid variable share purchase program

(‘‘PVSPP’’) with a third-party investment bank during the first quarter of 2006 and prepaid $1.7 billion

in exchange for the right to receive a variable number of shares of its common stock weekly over a one

year period beginning in the second quarter of fiscal 2006 and ending during the second quarter of

fiscal 2007. HP recorded the payment as a prepaid stock repurchase in the stockholders’ equity section

of its Consolidated Balance Sheet, and the payment was included in the cash flows from financing

activities in the Consolidated Statement of Cash Flows. In connection with this program, the investment

bank has purchased and will continue to trade shares of HP’s common stock in the open market over

time. The prepaid funds will be expended ratably over the term of the program.

115