HP 2006 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 7: Goodwill and Purchased Intangible Assets (Continued)

Based on the results of its annual impairment tests, HP determined that no impairment of the

Compaq trade name existed as of August 1, 2006 or August 1, 2005. However, future impairment tests

could result in a charge to earnings. HP will continue to evaluate the purchased intangible asset with

an indefinite life on an annual basis as of the beginning of its fourth fiscal quarter and whenever events

and changes in circumstances indicate that there may be a potential impairment.

The finite-lived purchased intangible assets consist of customer contracts, customer lists and

distribution agreements, which have weighted average useful lives of approximately eight years, and

developed and core technology, patents and product trademarks, which have weighted average useful

lives of approximately six years.

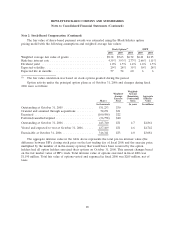

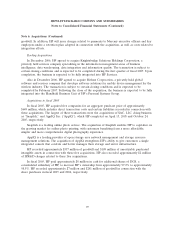

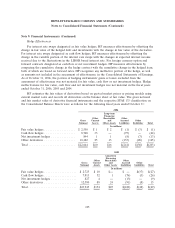

Estimated future amortization expense related to finite-lived purchased intangible assets at

October 31, 2006 was as follows:

Fiscal year: In millions

2007 ......................................................... $ 545

2008 ......................................................... 478

2009 ......................................................... 396

2010 ......................................................... 289

2011 ......................................................... 168

Thereafter ..................................................... 54

Total ......................................................... $1,930

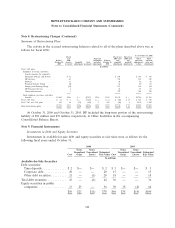

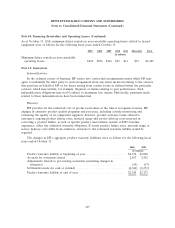

Note 8: Restructuring Charges

Fiscal 2005 Restructuring Plans

In the fourth quarter of fiscal 2005, HP’s Board of Directors approved a restructuring plan

designed to simplify HP’s structure, reduce costs and place greater focus on its customers. HP included

original estimates of 15,300 positions in the fiscal 2005 restructuring plan. Subsequent to the initial

estimate, HP reduced the number of total positions to 15,200. The initial charge for these actions

totaled $1.6 billion. After completion of HP’s voluntary severance programs in Europe and Asia, total

charges in connection with this plan, coupled with other final adjustments, are expected to exceed the

original charge by $108 million. During fiscal 2006, HP recognized charges of approximately

$167 million relating to employee severance and other benefits charges, including adjustment related to

reduce non-cash stock-based compensation by $14 million. HP also recognized a $6 million termination

benefit expense and a $3 million settlement and curtailment loss from the non-U.S. pension plans.

These charges were offset by settlement gains of $46 million from the U.S. pension plans and

curtailment gains of $24 million from the U.S. retiree medical program. The $167 million of severance

related charge was reflective of higher population of employees participating in higher cost early

retirement and voluntary programs with the greatest impact in Europe.

The charge in the fourth quarter of fiscal 2005 included approximately $400 million related to

employee severance and other benefits associated with the early retirement of 3,200 U.S. employees

who left HP by October 31, 2005. The majority of these costs were funded by HP’s pension plan assets.

The remaining charges of approximately $1.2 billion, which include approximately $100 million of

non-cash stock-based compensation, are related to severance and other benefits for approximately

99