HP 2006 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

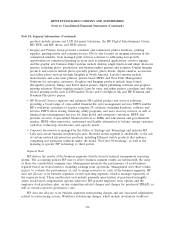

Note 18: Segment Information (Continued)

HP allocates its assets to its business segments based on the primary segments benefiting from the

assets. Corporate and unallocated assets are composed primarily of cash and cash equivalents. As

described above, fiscal 2006 segment asset information is stated based on the fiscal 2006 organizational

structure. Total assets by segment as well as for TSG and the reconciliation of segment assets to HP

consolidated total assets were as follows at October 31:

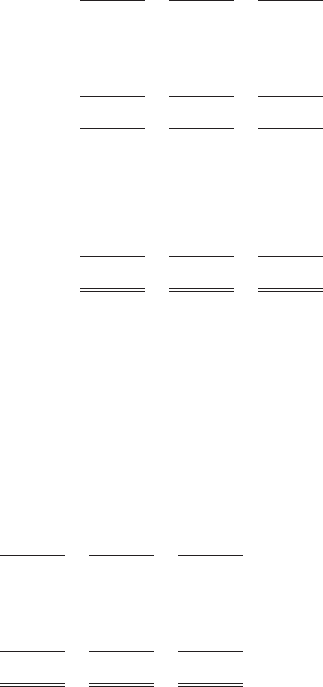

2006 2005 2004

In millions

Enterprise Storage and Servers ............................... $13,647 $13,591 $13,856

HP Services ............................................. 15,712 15,381 14,619

Software ............................................... 1,909 1,408 1,422

Technology Solutions Group ............................... $31,268 $30,380 $29,897

Personal Systems Group .................................... 12,237 11,277 10,622

Imaging and Printing Group ................................. 13,889 13,523 14,169

HP Financial Services ...................................... 7,927 7,856 7,992

Corporate Investments ..................................... 305 297 375

Corporate and unallocated assets ............................. 16,355 13,984 13,083

Total HP consolidated assets ................................. $81,981 $77,317 $76,138

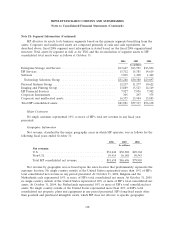

Major Customers

No single customer represented 10% or more of HP’s total net revenue in any fiscal year

presented.

Geographic Information

Net revenue, classified by the major geographic areas in which HP operates, was as follows for the

following fiscal years ended October 31:

2006 2005 2004

In millions

Net revenue:

U.S. ..................................... $32,244 $30,548 $29,362

Non-U.S. ................................. 59,414 56,148 50,543

Total HP consolidated net revenue ............... $91,658 $86,696 $79,905

Net revenue by geographic area is based upon the sales location that predominately represents the

customer location. No single country outside of the United States represented more than 10% of HP’s

total consolidated net revenue in any period presented. At October 31, 2006, Belgium and the

Netherlands each represented 10% or more of HP’s total consolidated net assets. At October 31, 2005,

no single country outside of the United States represented 10% or more of HP’s total consolidated net

assets. At October 31, 2004, the Netherlands represented 10% or more of HP’s total consolidated net

assets. No single country outside of the United States represented more than 10% of HP’s total

consolidated net property, plant and equipment in any period presented. HP’s long-lived assets other

than goodwill and purchased intangible assets, which HP does not allocate to specific geographic

138