HP 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

cost control measures, including the benefit from workforce reduction actions in ESS, the consolidation

and realignment of certain IPG research and development infrastructure and lower program spending.

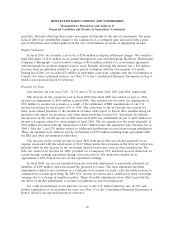

Selling, General and Administrative

Selling, general and administrative (‘‘SG&A’’) expense declined as a percentage of net revenue

during fiscal 2006 due primarily to the increase in net revenue outpacing SG&A expense growth. Total

SG&A expense increased slightly during fiscal 2006 as higher bonus accruals and stock-based

compensation expenses as well as increased marketing spending were offset in part by savings from

expense controls and restructuring actions and favorable currency impacts due to movement of the

dollar against the euro and the yen. As a percentage of net revenue, each of our segments experienced

a year-over-year decrease or no change in SG&A expense in fiscal 2006.

SG&A expense decreased slightly as a percentage of net revenue during fiscal 2005, as net revenue

growth was higher than the growth of SG&A due in part to tight company-wide expense controls. On

an absolute basis, SG&A spending increased 6.6% in fiscal 2005 due primarily to higher employee

bonuses earned in the second half of fiscal 2005 and unfavorable currency impacts.

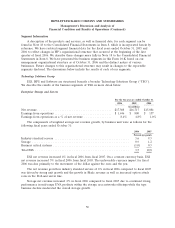

Pension Curtailment

In conjunction with management’s plan to restructure certain of our operations, as discussed in

Note 8 to the Consolidated Financial Statements in Item 8, we modified our U.S. retirement programs

to align more closely to industry practice. Effective January 1, 2006, we ceased pension accruals and

eliminated eligibility for the subsidized retiree medical program for current employees who did not

meet defined criteria based on age and years of service. As a result, we recognized a curtailment gain

of $199 million in the fourth quarter of fiscal 2005 stemming from the elimination of future benefit

accruals for the affected employee group. In fiscal 2006, we recognized additional curtailment gains,

which were included in our restructuring charges as described below.

For more information on our plan design changes, see Note 15 to the Consolidated Financial

Statements in Item 8, which is incorporated herein by reference.

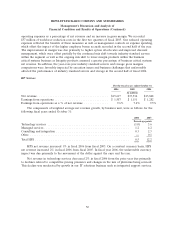

Restructuring Charges

Restructuring charges in fiscal year 2006 were $158 million. This included a net charge of

$233 million related to true-ups of severance and other related restructuring charges for all

restructuring plans, a $6 million termination benefits expense and a $3 million settlement and

curtailment loss from our non-U.S. pension plans related to the fiscal 2005 restructuring plan, which

was approved by our Board of Directors in the fourth quarter of fiscal 2005. These charges were

partially offset by a $46 million settlement gain from the U.S. pension plans, a $24 million curtailment

gain from the U.S. retiree medical program and a $14 million adjustment to reduce our non-cash stock-

based compensation expense, all related to our fiscal 2005 restructuring plan approved in the fourth

quarter of fiscal 2005.

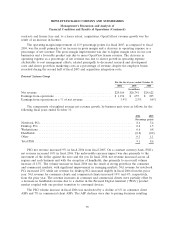

The fiscal 2005 restructuring plan was designed to simplify our structure, reduce costs and place

greater focus on our customers. We included original estimates of 15,300 positions to be eliminated in

the fiscal 2005 restructuring plan. Subsequent to the initial estimate, we reduced the number of total

positions to be eliminated to 15,200. Approximately 14,200 positions have been eliminated as of

October 31, 2006 in connection with this restructuring plan, including 3,200 U.S. employees who elected

to take early retirement.

46