HP 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

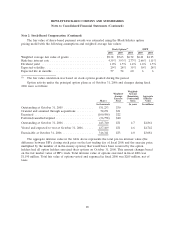

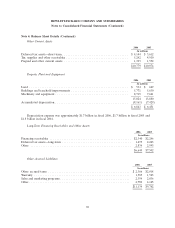

Note 2: Stock-Based Compensation (Continued)

exercise price of a stock option is equal to the fair market value of HP’s common stock on the option

grant date (as determined by the average of the highest and lowest reported sale prices of HP’s

common stock on that date). The contractual term of options granted since fiscal 2003 was generally

eight years, while the contractual term of options granted prior to fiscal 2003 was generally ten years.

Under the principal option plans, HP may choose, in certain cases, to establish a discounted exercise

price at no less than 75% of fair market value on the grant date. HP has not granted any discounted

options since fiscal 2003.

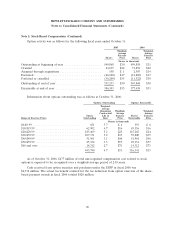

Under the principal option plans, HP granted certain employees cash, restricted stock awards, or

both. Restricted stock awards are nonvested stock awards that may include grants of restricted stock or

grants of restricted stock units. Cash and restricted stock awards are independent of option grants and

are generally subject to forfeiture if employment terminates prior to the release of the restrictions.

Such awards generally vest one to three years from the date of grant. During that period, ownership of

the shares cannot be transferred. Restricted stock has the same cash dividend and voting rights as other

common stock and is considered to be currently issued and outstanding. Restricted stock units have

dividend equivalent rights equal to the cash dividend paid on restricted stock. Restricted stock units do

not have the voting rights of common stock, and the shares underlying the restricted stock units are not

considered issued and outstanding. HP expenses the cost of the restricted stock awards, which HP has

determined to be the fair market value of the shares at the date of grant, ratably over the period

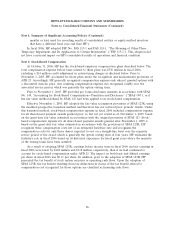

during which the restrictions lapse. In fiscal 2006, HP granted 1,492,000 shares of restricted stock with

a weighted-average grant date fair value of $32. In fiscal 2005, HP granted 6,773,000 shares of

restricted stock with a weighted-average grant date fair value of $21. HP had 5,492,000 shares of

restricted stock outstanding at October 31, 2006, 7,099,000 shares of restricted stock outstanding at

October 31, 2005 and 1,533,000 shares of restricted stock outstanding at October 31, 2004. In fiscal

2006, HP granted 33,000 shares of restricted stock units with a weighted-average grant date fair value

of $30. In fiscal 2005, HP granted 1,820,000 shares of restricted stock units with a weighted-average

grant date fair value of $21. HP had restricted stock units covering 873,000 shares outstanding at

October 31, 2006, 1,780,000 shares outstanding at October 31, 2005 and no shares outstanding at

October 31, 2004.

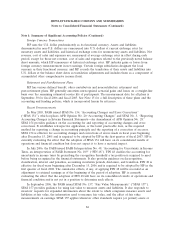

In light of new accounting guidance under SFAS 123R, beginning in the second quarter of fiscal

2005 HP reevaluated its assumptions used in estimating the fair value of employee options granted. As

part of this assessment, management determined that implied volatility calculated based on actively

traded options on HP common stock is a better indicator of expected volatility and future stock price

trends than historical volatility. Therefore, expected volatility in fiscal 2006 and 2005 was based on a

market-based implied volatility.

As part of its SFAS 123R adoption, HP also examined its historical pattern of option exercises in

an effort to determine if there were any discernable activity patterns based on certain employee

populations. From this analysis, HP identified three employee populations. HP used the Black-Scholes

option pricing model to value the options for each of the employee populations. The table below

presents the weighted average expected life in months of the combined three identified employee

populations. The expected life computation is based on historical exercise patterns and post-vesting

termination behavior within each of the three populations identified. The risk-free interest rate for

periods within the contractual life of the award is based on the U.S. Treasury yield curve in effect at

the time of grant.

88