HP 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 9: Financial Instruments (Continued)

Hedge Effectiveness

For interest rate swaps designated as fair value hedges, HP measures effectiveness by offsetting the

change in fair value of the hedged debt and investments with the change in fair value of the derivative.

For interest rate swaps designated as cash flow hedges, HP measures effectiveness by offsetting the

change in the variable portion of the interest rate swaps with the changes in expected interest income

received due to the fluctuations in the LIBOR based interest rate. For foreign currency option and

forward contracts designated as cash flow or net investment hedges, HP measures effectiveness by

comparing the cumulative change in the hedge contract with the cumulative change in the hedged item,

both of which are based on forward rates. HP recognizes any ineffective portion of the hedge, as well

as amounts not included in the assessment of effectiveness, in the Consolidated Statements of Earnings.

As of October 31, 2006, the portion of hedging instruments’ gains or losses excluded from the

assessment of effectiveness was not material for fair value, cash flow or net investment hedges. Hedge

ineffectiveness for fair value, cash flow and net investment hedges was not material in the fiscal years

ended October 31, 2006, 2005 and 2004.

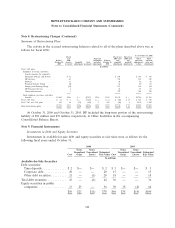

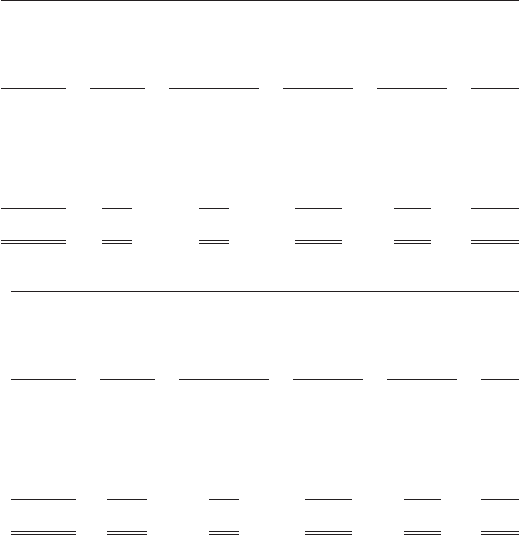

HP estimates the fair values of derivatives based on quoted market prices or pricing models using

current market rates and records all derivatives on the balance sheet at fair value. The gross notional

and fair market value of derivative financial instruments and the respective SFAS 133 classification on

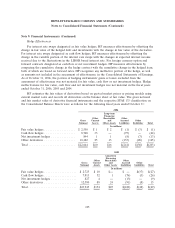

the Consolidated Balance Sheets were as follows for the following fiscal years ended October 31:

2006

Long-term

Financing

Other Receivables Other

Gross Current and Accrued Other

Notional Assets Other Assets Liabilities Liabilities Total

In millions

Fair value hedges .................. $ 2,550 $ 1 $ 2 $ (1) $ (3) $ (1)

Cash flow hedges .................. 8,768 33 — (97) — (64)

Net investment hedges .............. 844 1 1 (8) (7) (13)

Other derivatives .................. 10,482 25 13 (135) (28) (125)

Total ........................... $22,644 $60 $16 $(241) $(38) $(203)

2005

Long-term

Financing

Other Receivables Other

Gross Current and Accrued Other

Notional Assets Other Assets Liabilities Liabilities Total

In millions

Fair value hedges ................... $ 2,725 $ 10 $— $ — $(37) $(27)

Cash flow hedges ................... 7,813 52 1 (76) (3) (26)

Net investment hedges ............... 827 4 — (13) — (9)

Other derivatives ................... 12,580 88 24 (91) (8) 13

Total ............................ $23,945 $154 $25 $(180) $(48) $(49)

105