HP 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

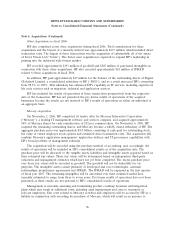

Note 6: Acquisitions (Continued)

goodwill. In addition, HP will incur charges related to payments to Mercury executive officers and key

employees under a retention plan adopted in connection with the acquisition, as well as costs related to

integration efforts.

Pending Acquisitions

In December 2006, HP agreed to acquire Knightsbridge Solutions Holdings Corporation, a

privately held services company specializing in the information management areas of business

intelligence, data warehousing, data integration and information quality. The transaction is subject to

certain closing conditions and is expected to be completed during the first quarter of fiscal 2007. Upon

completion, the business is expected to be fully integrated into HP Services.

Also in December 2006, HP agreed to acquire Bitfone Corporation, a privately held global

software and services company that develops software solutions for mobile device management for the

wireless industry. The transaction is subject to certain closing conditions and is expected to be

completed by February 2007. Following the close of the acquisition, the business is expected to be fully

integrated into the Handheld Business Unit of HP’s Personal Systems Group.

Acquisitions in fiscal 2005

In fiscal 2005, HP acquired five companies for an aggregate purchase price of approximately

$648 million, which includes direct transaction costs and certain liabilities recorded in connection with

these acquisitions. The largest of these transactions were the acquisitions of SAC, LLC, doing business

as ‘‘Snapfish,’’ and AppIQ, Inc. (‘‘AppIQ’’), which HP completed on April 15, 2005 and October 24,

2005, respectively.

Snapfish is a leading online photo service. The acquisition of Snapfish enables HP to capitalize on

the growing market for online photo printing, with customers benefiting from a more affordable,

simpler and more comprehensive digital photography experience.

AppIQ is a leading provider of open storage area network management and storage resource

management solutions. The acquisition of AppIQ strengthens HP’s ability to give customers a single

integrated console that controls and better manages their storage and server infrastructure.

HP recorded approximately $537 million of goodwill and $108 million of amortizable purchased

intangible assets in connection with these five acquisitions. HP also recorded approximately $2 million

of IPR&D charges related to these five acquisitions.

In fiscal 2005, HP paid approximately $8 million in cash for additional shares of DGS, a

consolidated subsidiary of HP, to increase HP’s ownership from approximately 97.2% to approximately

98.5%. HP recorded approximately $7 million and $281 million of goodwill in connection with the

share purchases in fiscal 2005 and 2004, respectively.

97