HP 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

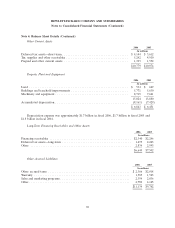

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

Foreign Currency Transactions

HP uses the U.S. dollar predominately as its functional currency. Assets and liabilities

denominated in non-U.S. dollars are remeasured into U.S. dollars at current exchange rates for

monetary assets and liabilities, and historical exchange rates for nonmonetary assets and liabilities. Net

revenue, cost of sales and expenses are remeasured at average exchange rates in effect during each

period, except for those net revenue, cost of sales and expenses related to the previously noted balance

sheet amounts, which HP remeasures at historical exchange rates. HP includes gains or losses from

foreign currency remeasurement in net earnings. Certain foreign subsidiaries designate the local

currency as their functional currency, and HP records the translation of their assets and liabilities into

U.S. dollars at the balance sheet dates as translation adjustments and includes them as a component of

accumulated other comprehensive income (loss).

Retirement and Post-Retirement Plans

HP has various defined benefit, other contributory and noncontributory retirement and

post-retirement plans. HP generally amortizes unrecognized actuarial gains and losses on a straight-line

basis over the remaining estimated service life of participants. The measurement date for all plans is

September 30 for fiscal 2006 and fiscal 2005. See Note 15 for a full description of these plans and the

accounting and funding policies, which is incorporated herein by reference.

Recent Pronouncements

In May 2005, FASB issued SFAS No. 154, ‘‘Accounting Changes and Error Corrections’’

(‘‘SFAS 154’’), which replaces APB Opinion No. 20 ‘‘Accounting Changes’’ and SFAS No. 3, ‘‘Reporting

Accounting Changes in Interim Financial Statements—An Amendment of APB Opinion No. 28.’’

SFAS 154 provides guidance on the accounting for and reporting of accounting changes and error

corrections. It establishes retrospective application, or the latest practicable date, as the required

method for reporting a change in accounting principle and the reporting of a correction of an error.

SFAS 154 is effective for accounting changes and corrections of errors made in fiscal years beginning

after December 15, 2005 and is required to be adopted by HP in the first quarter of fiscal 2007. HP is

currently evaluating the effect that the adoption of SFAS 154 will have on its consolidated results of

operations and financial condition but does not expect it to have a material impact.

In July 2006, the FASB issued FASB Interpretation No. 48, ‘‘Accounting for Uncertainty in Income

Taxes, an interpretation of FASB Statement No. 109’’ (‘‘FIN 48’’). FIN 48 clarifies the accounting for

uncertainty in income taxes by prescribing the recognition threshold a tax position is required to meet

before being recognized in the financial statements. It also provides guidance on derecognition,

classification, interest and penalties, accounting in interim periods, disclosure, and transition. FIN 48 is

effective for fiscal years beginning after December 15, 2006 and is required to be adopted by HP in the

first quarter of fiscal 2008. The cumulative effects, if any, of applying FIN 48 will be recorded as an

adjustment to retained earnings as of the beginning of the period of adoption. HP is currently

evaluating the effect that the adoption of FIN 48 will have on its consolidated results of operations and

financial condition and is not yet in a position to determine such effects.

In September 2006, the FASB issued SFAS No. 157, ‘‘Fair Value Measurements’’ (‘‘SFAS 157’’).

SFAS 157 provides guidance for using fair value to measure assets and liabilities. It also responds to

investors’ requests for expanded information about the extent to which companies measure assets and

liabilities at fair value, the information used to measure fair value, and the effect of fair value

measurements on earnings. SFAS 157 applies whenever other standards require (or permit) assets or

84