HP 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168

|

|

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

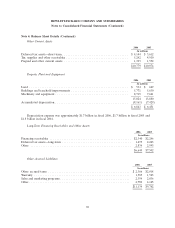

Note 4: Balance Sheet Details (Continued)

Other Current Assets

2006 2005

In millions

Deferred tax assets—short-term ...................................... $ 4,144 $ 3,612

Tax, supplier and other receivables .................................... 5,242 4,910

Prepaid and other current assets ..................................... 1,393 1,552

$10,779 $10,074

Property, Plant and Equipment

2006 2005

In millions

Land ......................................................... $ 534 $ 629

Buildings and leasehold improvements ................................. 5,771 5,630

Machinery and equipment .......................................... 8,719 7,621

15,024 13,880

Accumulated depreciation .......................................... (8,161) (7,429)

$ 6,863 $ 6,451

Depreciation expense was approximately $1.7 billion in fiscal 2006, $1.7 billion in fiscal 2005 and

$1.8 billion in fiscal 2004.

Long-Term Financing Receivables and Other Assets

2006 2005

In millions

Financing receivables ............................................... $2,340 $2,246

Deferred tax assets—long-term ........................................ 1,475 2,263

Other .......................................................... 2,834 2,993

$6,649 $7,502

Other Accrued Liabilities

2006 2005

In millions

Other accrued taxes ............................................... $ 2,366 $2,018

Warranty ....................................................... 1,585 1,563

Sales and marketing programs ........................................ 2,394 2,036

Other .......................................................... 4,789 4,145

$11,134 $9,762

94