HP 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

from lower component costs as well as competitive pricing pressures, which were partially offset by a

strong monitor attach rate in commercial desktops PCs.

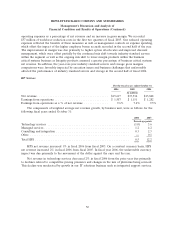

PSG earnings from operations as a percentage of net revenue increased by 1.4 percentage points in

fiscal 2006 from fiscal 2005 as a result of gross margin improvement and a decrease in operating

expenses as a percentage of revenue. The gross margin improvement was due primarily to reduced

supply chain costs and warranty expense as a percentage of net revenue, combined with component

cost declines. The operating expense decline as a percentage of net revenue was the result primarily of

the increased net revenue and continued efforts on improving cost structure through efficiency

measures. The operating expenses decreased slightly in fiscal 2006 due primarily to savings from our

expense controls, which were partially offset by higher bonus accruals in fiscal 2006.

PSG net revenue increased 9% in fiscal 2005 from fiscal 2004. On a constant currency basis, PSG’s

net revenue increased 7% in fiscal 2005. The favorable currency impact was due primarily to the

weakening of the dollar against the euro and the yen for the first three quarters of fiscal 2005 and to a

lesser extent in the fourth fiscal quarter as the dollar strengthened against the euro and the yen during

that period. In fiscal 2005, net revenue increased across all regions as a result of a 13% volume

increase, particularly in consumer and commercial clients. Double digit unit growth in Asia Pacific and

EMEA drove the revenue increase. In fiscal 2005, net revenue increases in notebook and desktop PCs

were 16% and 3%, respectively, while consumer clients and commercial clients increased 10% and 7%,

respectively, from the prior year. The revenue increases in consumer and commercial clients were offset

partially by a decline in handhelds revenue. The performance of digital entertainment products, such as

the Apple iPod from HP, added to the growth in net revenue for the fiscal year. In the fourth quarter

of fiscal 2005, we discontinued reselling the Apple iPod.

The PSG volume increase was moderated by a decline of 4% in ASPs, with consumer clients and

commercial clients declining 8% and 5%, respectively, in fiscal 2005. The declines in notebook and

desktop ASPs were offset slightly by the digital entertainment mix and an increase in handheld ASPs.

The decline in ASPs was due mainly to changes in the notebook product line-up that leveraged declines

in component costs and competitive pressures in consumer PCs.

PSG earnings from operations as a percentage of net revenue increased by 1.7 percentage points in

fiscal 2005 from fiscal 2004. The increase was the result of gross margin improvement combined with

flat operating expenses as a percentage of revenue. The gross margin improvement was due primarily

to component cost declines, a product mix shift toward higher margin notebook PCs, reduced warranty

costs and favorable currency impacts. Operating expense as a percentage of revenue was flat, as the

impact of the employee bonuses recorded in the second half of the year was offset by continued cost

control measures.

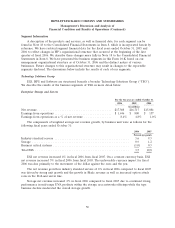

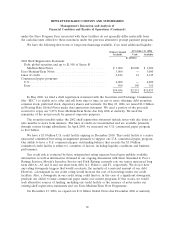

Imaging and Printing Group

For the fiscal years ended October 31

2006 2005 2004

In millions

Net revenue ........................................... $26,786 $25,155 $24,199

Earnings from operations ................................. $ 3,978 $ 3,413 $ 3,843

Earnings from operations as a % of net revenue ................ 14.9% 13.6% 15.9%

56