HP 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

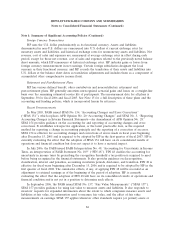

Note 3: Net Earnings Per Share (‘‘EPS’’) (Continued)

48 million options in fiscal 2006, whose combined exercise price, unamortized fair value and excess tax

benefit were greater than the average market price for HP’s common stock as these shares were also

anti-dilutive. In addition, HP excluded approximately 8 million shares of HP stock issuable upon the

assumed conversion of zero-coupon subordinated notes from the calculation of diluted EPS in fiscal

2005 because the effect was antidilutive.

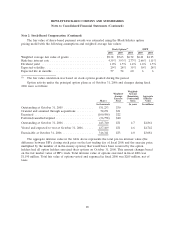

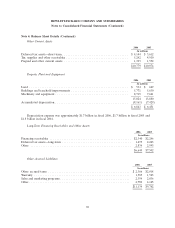

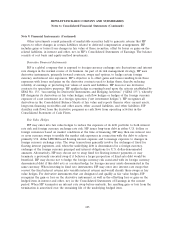

Note 4: Balance Sheet Details

Balance sheet details were as follows for the following fiscal years ended October 31:

Accounts and Financing Receivables

2006 2005

In millions

Accounts receivable ............................................... $11,093 $10,130

Allowance for doubtful accounts ..................................... (220) (227)

$10,873 $ 9,903

Financing receivables ............................................. $ 2,480 $ 2,608

Allowance for doubtful accounts ..................................... (40) (57)

$ 2,440 $ 2,551

HP has revolving trade receivables based facilities permitting it to sell certain trade receivables to

third parties on a non-recourse basis. The aggregate maximum capacity under these programs was

approximately $477 million as of October 31, 2006 and there was approximately $150 million available

under these programs. In fiscal 2006, HP had another facility that was subject to a maximum amount of

525 million euros (the ‘‘Euro Program’’), which was terminated on October 31, 2006. HP sold

approximately $8.6 billion of trade receivables during fiscal 2006, including approximately $5.9 billion

under the Euro Program. Fees associated with these facilities do not generally differ materially from

the cash discounts offered to these customers under the previous alternative prompt payment programs.

Inventory

2006 2005

In millions

Finished goods .................................................... $5,424 $4,940

Purchased parts and fabricated assemblies ................................ 2,326 1,937

$7,750 $6,877

93