HP 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

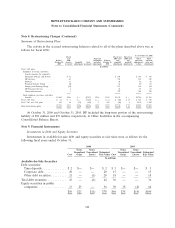

Note 12: Borrowings (Continued)

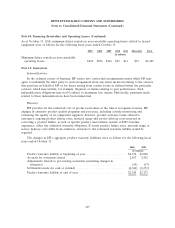

Long-Term Debt

Long-term debt was as follows for the following fiscal years ended October 31:

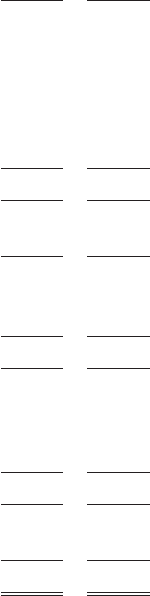

2006 2005

In millions

U.S. Dollar Global Notes

$1,000 issued December 2001 at 5.75%, due December 2006 ................ $1,000 $ 999

$1,000 issued June 2002 at 5.5%, due July 2007 ......................... 999 998

$500 issued June 2002 at 6.5%, due July 2012 .......................... 498 498

$500 issued March 2003 at 3.625%, due March 2008 ...................... 499 498

$1,000 issued May 2006 at floating interest rate, due May 2009 .............. 1,000 —

3,996 2,993

Euro Medium-Term Note Programme

A750 issued July 2001 at 5.25%, matured and paid July 2006 ................ — 900

Series A Medium-Term Notes

$200 issued December 2002 at 3.375%, matured and paid December 2005 ...... — 200

$50 issued in December 2002 at 4.25%, due December 2007 ................ 50 50

50 250

Other

$505, U.S. dollar zero-coupon subordinated convertible notes, issued in October

and November 1997 at an imputed rate of 3.13%, due 2017 (‘‘LYONs’’) ...... 360 349

Other, including capital lease obligations, at 3.46%-15%, due 2005-2029 ......... 228 157

588 506

Fair value adjustment related to SFAS No. 133 ........................... (63) (75)

Less current portion ............................................... (2,081) (1,182)

$ 2,490 $ 3,392

HP may redeem some or all of the Global Notes and the Series A Medium-Term Notes

(collectively, the ‘‘Notes’’), as set forth in the above table, at any time at the redemption prices

described in the prospectus supplements relating thereto. The Notes are senior unsecured debt.

In May 2006, HP filed a shelf registration statement (the ‘‘2006 Shelf Registration Statement’’)

with the SEC to enable HP to offer and sell, from time to time, in one or more offerings, debt

securities, common stock, preferred stock, depositary shares and warrants. On May 23, 2006, HP issued

$1.0 billion in Floating Rate Global Notes under this registration statement. The Floating Rate Global

Notes bear interest at a floating rate equal to the three-month USD LIBOR plus 0.125% per annum.

HP used a portion of the proceeds received to repay its 5.25% Euro Medium-Term Notes due

July 2006 at maturity and the remainder of the net proceeds for general corporate purposes.

HP registered the sale of up to $3.0 billion of debt or global securities, common stock, preferred

stock, depositary shares and warrants under a shelf registration statement in March 2002 (the ‘‘2002

Shelf Registration Statement’’). In December 2002, HP filed a supplement to the 2002 Shelf

Registration Statement, which allows HP to offer from time to time up to $1.5 billion of Medium-Term

109