HP 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

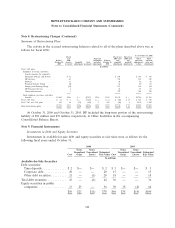

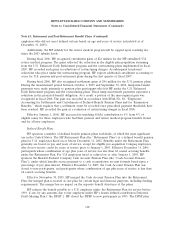

Note 12: Borrowings (Continued)

Notes, Series B, due nine months or more from the date of issuance (the ‘‘Series B Medium-Term Note

Program’’). As of October 31, 2006, HP has not issued Medium-Term Notes pursuant to the Series B

Medium-Term Note Program.

HP registered the sale of up to $3.0 billion of Medium-Term Notes under its Euro Medium-Term

Note Programme filed with the Luxembourg Stock Exchange. HP can denominate these notes in any

currency, including the euro. These notes have not been and will not be registered in the United States.

In July 2006, HP repaid the previously issued 750 million euro notes at maturity under this programme.

The LYONs are convertible by the holders at an adjusted rate of 15.09 shares of HP common

stock for each $1,000 face value of the LYONs, payable in either cash or common stock at HP’s

election. At any time, HP may redeem the LYONs at book value, payable in cash only. In

December 2000, the Board of Directors authorized a repurchase program for the LYONs that allowed

HP to repurchase the LYONs from time to time at varying prices. The last repurchase under this

program occurred in fiscal 2002.

On December 15, 2006, HP repaid $1.0 billion Global Notes due December 2006 at maturity.

HP has a U.S. commercial paper program with a $6.0 billion capacity. Its subsidiaries are

authorized to issue up to an additional $1.0 billion of commercial paper, of which $500 million of

capacity is currently available to be used by Hewlett-Packard International Bank PLC, a wholly-owned

subsidiary of HP for its Euro Commercial Paper/Certificate of Deposit Programme.

Until December 15, 2005, HP had two U.S. credit facilities consisting of a $1.5 billion 364-day

credit facility expiring in March 2006 and a $1.5 billion 5-year credit facility expiring in March 2009.

The credit facilities were subject to a weighted average commitment fee of 7.25 basis points per annum.

On December 15, 2005, HP replaced the two credit facilities with a $3.0 billion 5-year credit facility

that is subject to a commitment fee of 6.5 basis points per annum. Interest rates and other terms of

borrowing under the credit facility vary, based on HP’s external credit ratings. The credit facility is a

senior unsecured committed borrowing arrangement primarily to support the issuance of U.S.

commercial paper. No amounts are outstanding under the credit facility.

HP also maintains lines of credit of approximately $2.1 billion from a number of financial

institutions that are uncommitted and available through various foreign subsidiaries.

Included in Other, including capital lease obligations, are borrowings that are collateralized by

certain financing receivable assets. As of October 31, 2006, the carrying value of the assets

approximated the carrying value of the borrowings of $16.4 million.

At October 31, 2006, HP had up to $12.5 billion of available borrowing resources under the 2002

Shelf Registration Statement and other programs described above. HP also may issue additional debt

securities, common stock, preferred stock, depositary shares and warrants under the 2006 Shelf

Registration Statement.

110