HP 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

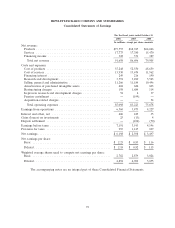

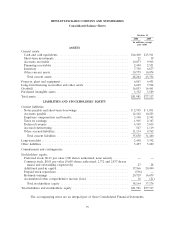

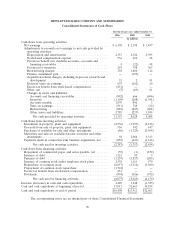

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

HP classifies its investments in debt securities and its equity investments in public companies as

available-for-sale securities and carries them at fair value. HP determines fair values for investments in

public companies using quoted market prices. HP records the unrealized gains and losses on

available-for-sale securities, net of taxes, in accumulated other comprehensive income (loss).

HP carries equity investments in privately-held companies at the lower of cost or fair value. HP

may estimate fair values for investments in privately-held companies based upon one or more of the

following: pricing models using historical and forecasted financial information and current market rates;

liquidation values; the values of recent rounds of financing; and quoted market prices of comparable

public companies.

Losses on Investments

HP monitors its investment portfolio for impairment on a periodic basis. In the event that the

carrying value of an investment exceeds its fair value and the decline in value is determined to be

other-than-temporary, HP records an impairment charge and establishes a new cost basis for the

investment at its current fair value. In order to determine whether a decline in value is

other-than-temporary, HP evaluates, among other factors: the duration and extent to which the fair

value has been less than the carrying value; the financial condition of and business outlook for the

company, including key operational and cash flow metrics, current market conditions and future trends

in the company’s industry; the company’s relative competitive position within the industry; and HP’s

intent and ability to retain the investment for a period of time sufficient to allow for any anticipated

recovery in fair value.

HP determined the declines in value of certain investments to be other-than-temporary.

Accordingly, HP recorded impairments of approximately $8 million in fiscal 2006, $43 million in fiscal

2005 and $26 million in fiscal 2004. HP includes these impairments in gains/(losses) on investments in

the Consolidated Statements of Earnings. Depending on market conditions, HP may record additional

impairments on its investment portfolio in the future.

Concentrations of Credit Risk

Financial instruments that potentially subject HP to significant concentrations of credit risk consist

principally of cash and cash equivalents, investments, accounts receivable from trade customers and

from contract manufacturers, financing receivables and derivatives.

HP maintains cash and cash equivalents, short and long-term investments, derivatives and certain

other financial instruments with various financial institutions. These financial institutions are located in

many different geographical regions and HP’s policy is designed to limit exposure with any one

institution. As part of its cash and risk management processes, HP performs periodic evaluations of the

relative credit standing of the financial institutions. HP has not sustained material credit losses from

instruments held at financial institutions. HP utilizes forward contracts and other derivative contracts to

protect against the effects of foreign currency fluctuations. Such contracts involve the risk of

non-performance by the counterparty, which could result in a material loss.

HP sells a significant portion of its products through third-party distributors and resellers and, as a

result, maintains individually significant receivable balances with these parties. If the financial condition

or operations of these distributors and resellers deteriorate substantially, HP’s operating results could

be adversely affected. The ten largest distributor and reseller receivable balances collectively, which

were concentrated primarily in North America, represented approximately 21% of gross accounts

82