HP 2006 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2006 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 9: Financial Instruments (Continued)

Corporate debt consists primarily of loans to the other companies that are guaranteed by standby

letters of credit issued by third party banks. Other debt securities consist primarily of fixed-interest

securities invested for early retirement purposes as required by German laws. Equity securities in public

companies are primarily common stock.

HP estimated the fair values based on quoted market prices or pricing models using current

market rates. These estimated fair values may not be representative of actual values that could have

been realized as of year-end or that will be realized in the future.

The gross unrealized losses as of October 31, 2006 were associated with other debt securities with

a fair value of $18 million and had been in a continuous loss position for fewer than 12 months. The

gross unrealized losses as of October 31, 2005 were associated with investments in public equity

securities with a fair value of $10 million and had been in a continuous loss position for fewer than

12 months.

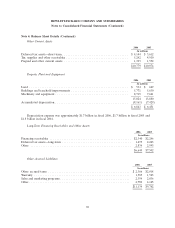

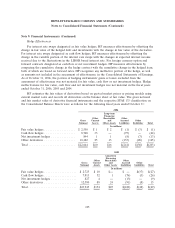

Contractual maturities of available-for-sale debt securities were as follows at October 31, 2006:

Available-for-Sale

Securities

Estimated

Cost Fair Value

In millions

Due in less than one year ............................................ $22 $22

Due in 1-5 years ................................................... 21 20

$43 $42

Proceeds from sales or maturities of available-for-sale and other securities were $91 million in

fiscal 2006, $2.1 billion in fiscal 2005 and $4.3 billion in fiscal 2004. The gross realized gains and losses

totaled $35 million and $2 million, respectively, in fiscal 2006. Gross realized gains and losses totaled

$31 million and $1 million, respectively, in fiscal 2005. Gross realized gains and losses totaled

$27 million and $4 million, respectively, in fiscal 2004. The specific identification method is used to

account for gains and losses on available-for-sale securities.

A summary of the carrying values and balance sheet classification of all investments in debt and

equity securities was as follows for the following fiscal years ended October 31:

2006 2005

In millions

Available-for-sale debt securities ......................................... $ 22 $ 18

Short-term investments ............................................... 22 18

Available-for-sale debt securities ......................................... 20 18

Available-for-sale equity securities ........................................ 36 64

Equity securities in privately-held companies and other investments ................ 362 353

Included in long-term financing receivables and other assets ..................... 418 435

Total investments ..................................................... $440 $453

102